When most people find themselves in a situation where they are juggling multiple high-interest loans, they think about merging their debt into one. When done right with tailored debt consolidation loans, it can help a person avoid debt stress and clear out debt faster.

However, like any financial tool, debt consolidation has potential downsides that could worsen the situation if you are not careful. In this guide, we’ll let you know what to expect to help you decide whether this is the best solution to your financial needs.

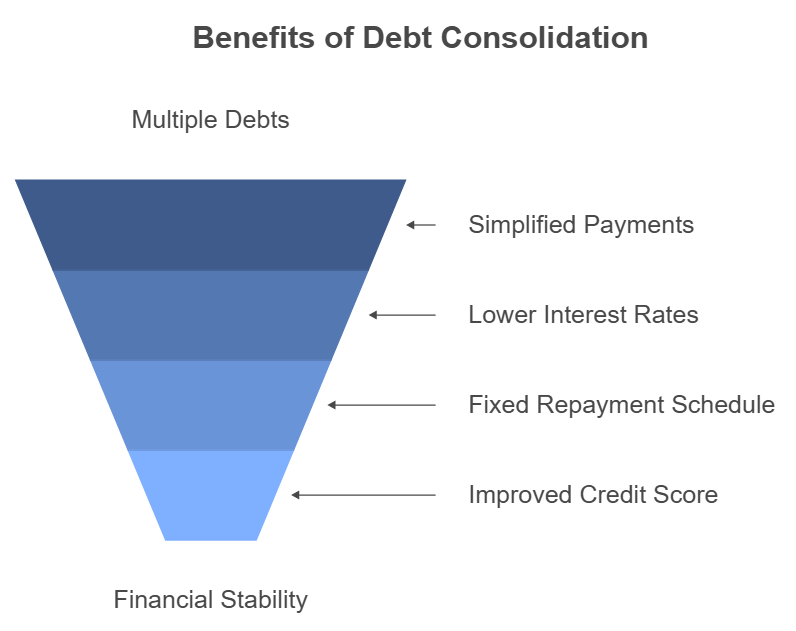

Pros of Debt Consolidation

Debt consolidation offers several benefits.

Simplified Payments

One of the biggest benefits of debt consolidation is that everything is simplified. Instead of worrying about multiple creditors and monthly payments to each, all loans are converted into a single loan you can pay monthly. This helps make it easy to keep up with the payments as there’s no risk of missing a loan by accident.

Potential for Lower Interest Rates

Credit card loans and various personal loans often have high interest rates. When shopping around for a debt consolidation loan, you can find products that have lower interest rates than the loans you are servicing. In such a case, the consolidation loan will help you save money in the long term, especially if you don’t stretch your loan longer than necessary. You can use the extra savings to add to your principal repayment, clearing your debt faster.

Fixed Repayment Schedule

Credit card loans can easily cause debt stress as the payments fluctuate based on minimum payments. Many consolidation loans come with a fixed repayment schedule, which gives you predictability and peace of mind. At the end of every month, you know the amount you need to pay, so it’s easier to stay disciplined – and clear out your debt faster.

Potential for Improved Credit Score

When done right, debt consolidation can help improve your credit score. Instead of dealing with multiple creditors and risking a default on one of the loans, it’s easier to make consistent payments to one creditor. If you keep up with the monthly payments, this will help significantly improve your credit score.

Cons of Debt Consolidation

Debt consolidation also has several potential drawbacks you should be aware of.

Temptation to Accumulate More Debt

Once your credit card loans are paid off through a debt consolidation loan, it’s easier to mistake this for a fresh start. If you don’t put down a solid plan for getting out of debt, you’ll easily find yourself in the common trap of using your credit cards again. In such a case, you’ll end up with more debt as you have to pay the new ones on top of the consolidation loan. If you merge your loans, you need to change your spending habits.

Upfront and Hidden Fees

Most debt consolidation loans come with fees and charges that may not be clear from the start. The most common are transfer fees, origination fees, and early repayment penalties. If you don’t consider them from the start, it’s easy to think that you’ll make savings but end up spending more. A creditor may not charge all of them, but look at the ones they charge and their percentages. Combine this with the interest rates and see if there’s potential for savings.

Potential Impact on Credit Score

When applying for the loan, the creditor will make a hard inquiry on your credit report. This will temporarily lower your score. However, the drop will be short-lived if you manage your financial situation well to make timely payments and avoid new debt.

It’s Not a Complete Solution

Debt consolidation will make it easy to manage your debt, but it won’t address the root cause of the debt. For this, you’ll need to assess your financial habits. Are you over budgeting or overspending? Consolidation is only a temporary relief you should use to chart a way out of debt.

Is Debt Consolidation Right for You?

Debt consolidation offers a way to simplify your payments by only dealing with a single creditor, and it can also be a way to save money and improve your credit score. However, it’s only effective if done right, as you can easily accumulate more debt or miss a payment if you don’t address your financial situation. Before you go for a loan, assess your financial situation and then weigh the pros and cons. This will help you decide whether consolidation can help you move closer to being debt free or you need a different approach.