Let’s be honest—most of us didn’t wake up this morning excited to talk about finance formulas. But if you’re someone who wants to make smarter investment decisions, whether you’re running a business or just curious about what to do with your money, you need to understand Net Present Value—or NPV.

Don’t worry, though. I’m going to break this down like we’re sitting at a coffee shop, not inside a Wall Street boardroom.

So, What Is Net Present Value?

The Super-Simple Definition

Net Present Value (NPV) is just a fancy way of asking:

“If I’m going to make money in the future, what’s it actually worth today?”

It’s like choosing between $100 today or $110 a year from now. That extra $10 might seem worth the wait—or maybe not, depending on inflation, interest rates, and a few other things. NPV helps you figure that out.

Why Time Messes With Money

This is based on the “time value of money” concept. Basically:

- A dollar today is worth more than a dollar tomorrow.

- Because you could invest today’s dollar and earn interest.

- Or, let’s be real—prices could go up, and tomorrow’s dollar won’t stretch as far.

Why You Should Care About NPV

Whether you’re:

- Starting a small business

- Buying a piece of equipment

- Investing in real estate

- Or just weighing two options…

NPV helps you choose what’s worth your money—and what’s just shiny on the surface.

The NPV Formula (But Let’s Not Freak Out)

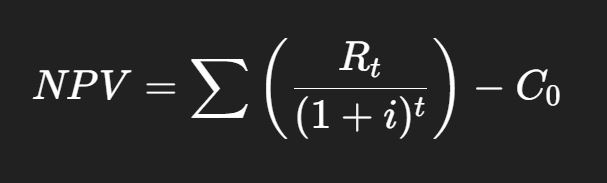

Here’s the “official” formula:

And here’s the translation:

- Rt = Money you’ll get in the future (cash inflow)

- i = Your discount rate (aka, your desired return or cost of capital)

- t = Time in years

- C₀ = What you’re investing now

All it’s doing is bringing future cash back to today’s value… and subtracting what you paid to get it.

If the result is positive, that’s good news.

If it’s negative, walk away—or think twice.

How to Calculate NPV Without Needing a Finance Degree

Let’s go step by step, using a relatable example.

Step 1: Map Out Your Future Cash

Say you’re planning to open a little donut shop. You expect:

- Year 1: $10,000

- Year 2: $12,000

- Year 3: $15,000

Step 2: Pick a Discount Rate

This is just the return you’d like to get. Maybe you’re okay with 10%, which is common for small business calculations.

Step 3: Count the Years

We’re looking at a 3-year period.

Step 4: Crunch the Numbers

Now we bring those cash flows back to today:

- Year 1: $10,000 ÷ (1 + 0.10)^1 = $9,090.91

- Year 2: $12,000 ÷ (1 + 0.10)^2 = $9,917.36

- Year 3: $15,000 ÷ (1 + 0.10)^3 = $11,267.68

Step 5: Subtract Your Investment

Let’s say you put in $25,000 up front.

Now add those numbers:

NPV = $9,090.91 + $9,917.36 + $11,267.68 – $25,000 = $1,275.95

👏 That’s a positive NPV, which means your donut dream might actually be a sweet deal.

NPV in the Real World: A Few Quick Examples

Example 1: Launching a New Business

You’re investing $25K, and you forecast decent cash flows. If your NPV says you’ll make more than what you put in—go for it.

Example 2: Buying Equipment

You’re spending $50K on a new machine that will save $15K a year for five years. NPV helps you decide if those savings are really worth the cost today.

Example 3: Choosing Between Two Projects

Say Project A has an NPV of $12K and Project B has $9K. Even if B “feels” better, numbers don’t lie. Go with the higher NPV.

The Good Stuff About NPV

- It respects the time value of money.

- It gives you a clear number: not just percentages or timelines.

- It works great for comparing options.

But It’s Not Perfect

- Your NPV changes depending on the discount rate you use.

- You’re guessing your future cash flows (and we all know life is unpredictable).

- It doesn’t show emotional or brand value—just cold hard cash.

NPV vs The Other Guys

NPV vs IRR

NPV = Actual dollar value

IRR = The return rate that makes NPV zero

(Use both if you can—NPV tells you how much, IRR tells you how efficient.)

NPV vs Payback Period

Payback tells you when you get your money back.

NPV tells you how much you’ll really make.

NPV vs ROI

ROI = Simple % return.

NPV = Real dollars adjusted for time and risk.

How to Actually Calculate NPV (Without a Brain Cramp)

Use Excel (So Easy)

Here’s the basic formula:

=NPV(discount_rate, value1, value2, ...) - initial_investment

Example:

=NPV(0.10, 10000, 12000, 15000) - 25000

Boom—NPV in seconds.

Use Online Tools

Not into Excel? Try:

- calculator.net/npv-calculator

- investopedia.com/npv

You’ll just plug in your numbers and let the tool do the math.

A Few Pro Tips for Real-World NPV

- Be conservative with your cash flow predictions. Life happens.

- Choose a reasonable discount rate—not too high, not too low.

- Try different rates to test your results (that’s called sensitivity analysis).

- Don’t forget to factor in hidden costs like maintenance, inflation, or taxes.

Quick FAQs

Q: What does a negative NPV mean?

A: You’re losing money. Rethink the project.

Q: Is higher NPV always better?

A: Yep. The higher the NPV, the more value you’re creating.

Q: Can I use NPV for personal finance decisions?

A: Absolutely! Try it for things like education costs, rental property decisions, or even major purchases.

Q: What’s a good discount rate?

A: Depends on your expectations, but 8–12% is a good ballpark for most personal or business investments.

Bottom Line

Net Present Value might sound like financial jargon, but once you get the hang of it, it becomes one of your smartest decision-making tools.

Here’s what to remember:

- If the NPV is positive—you’re creating value.

- If it’s negative—you’re better off not investing.

- And if you’re comparing options, the higher NPV wins.

So whether you’re deciding on a side hustle, launching a startup, or just getting serious about your financial game—NPV has your back.

Bonus: Mistakes to Avoid

- Forgetting to factor in inflation

- Picking a random discount rate because it “felt right”

- Being too optimistic with your cash flow estimates

- Ignoring extra costs (fees, repairs, etc.)