Ever heard someone toss around the term “IRR” like it’s just another financial buzzword? Let’s clear the air—Internal Rate of Return isn’t some secret code only Wall Street analysts understand. It’s actually one of the most useful tools you can have in your decision-making toolbox—especially if you’re trying to figure out whether an investment is actually worth your time (and money).

Whether you’re running a business, investing in real estate, or just trying to decide between two opportunities, understanding IRR could help you make smarter choices. This guide is built for real people like you—no MBA required.

What Is IRR—Like, Really?

IRR, or Internal Rate of Return, is the rate of return where the Net Present Value (NPV) of a project becomes zero. That’s the fancy way of saying: it’s the exact rate where the money you’re getting back from an investment equals the money you put into it, accounting for time.

You can think of IRR as the sweet spot—a percentage—that tells you “Hey, this project earns this much annually, based on its future cash flows.”

If the IRR is higher than your minimum required return (also called your hurdle rate), then the investment is probably worth it. If not? Maybe hold off.

Why Should You Care About IRR?

Let’s say you have two business projects or real estate deals in front of you. One promises big returns five years from now. The other gives you smaller but steady returns every year.

How do you compare them?

That’s where IRR steps in. It helps level the playing field by giving you a single percentage that shows how much you’re really earning per year, factoring in timing, cash flow, and investment size.

The IRR Formula (Don’t Worry—We’ll Keep It Light)

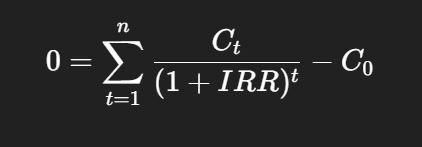

Here’s the classic IRR formula:

Where:

- C0C_0C0 is your initial investment (typically a negative number)

- CtC_tCt is the cash you expect to receive each period

- ttt is the time period

- IRR is the rate you’re solving for

Now, unless you love math, you probably won’t solve this by hand. And that’s okay. This formula can’t be solved algebraically anyway. That’s what spreadsheets and calculators are for.

How to Actually Calculate IRR

You’ve got four main ways to get the IRR without breaking a sweat:

1. Trial and Error (Old-School Style)

Plug different rates into the NPV formula until you find the one that gets you as close to zero as possible. It’s tedious, but a great learning exercise.

2. Excel or Google Sheets (Highly Recommended)

Just use:

IRR(A1:A6)

Your cells should have the initial investment (negative value) followed by all future cash flows. Press enter, and boom—you get the IRR.

3. Financial Calculator

Enter the cash flows, hit IRR, done. Great if you’re on the go.

4. Financial Software or Python

If you’re more advanced, tools like Python or R can handle IRR in bulk.

Let’s Walk Through a Simple Example

You invest $10,000 in a project. Over the next four years, you expect to get the following:

| Year | Cash Flow |

|---|---|

| 0 | -$10,000 |

| 1 | $2,500 |

| 2 | $3,000 |

| 3 | $3,500 |

| 4 | $4,000 |

Using Excel’s =IRR() function, you’ll find your IRR is around 11.79%.

What that means: if you expect at least an 8–10% return to make this worthwhile, then yes, this project might be a green light.

Real-World Scenarios Where IRR Shines

Let’s bring it down to earth. Here are a few real-life situations where IRR makes a difference:

Comparing Two Projects

Imagine you’re choosing between two investment projects:

- Project A: IRR = 14%

- Project B: IRR = 11%

If both cost the same, Project A wins in terms of return—unless Project B has other benefits (like lower risk or longer life). IRR gives you the number, but you still need to use your brain.

Real Estate Rental Property

You buy a house for $200,000. You earn $20,000/year in rent and sell it in 10 years for $250,000. Plug these cash flows into Excel and see your IRR. That one number helps you compare this house to stocks, bonds, or any other opportunity.

Startup Investment

Let’s say you invest $100,000 in a startup. Five years later, you exit with $300,000. Your IRR? It’s around 24.57%. Not bad. IRR tells you how fast your money grew.

What Does IRR Actually Tell You?

Here’s how to read it:

- If IRR > your hurdle rate → good investment

- If IRR < hurdle rate → might want to pass

- If IRR = hurdle rate → you’re just breaking even

But don’t stop there. IRR isn’t perfect (more on that soon). Still, it’s a super quick gut-check for investment quality.

IRR vs NPV vs ROI: What’s the Difference?

| Metric | Tells You | Best Used For |

|---|---|---|

| IRR | Annual rate of return | Comparing % returns |

| NPV | Dollar value of return | Measuring real value created |

| ROI | Total return % | Quick estimate |

IRR is great for comparing apples to apples—but it doesn’t tell you how big the apple is. That’s where NPV comes in. Always consider both.

The Not-So-Perfect Side of IRR

It’s not all sunshine and high returns. IRR has a few limitations you should know:

1. You Can Get Multiple IRRs

If your project has mixed cash flows (some negative, some positive, then negative again), you could end up with two or more IRRs. That’s confusing.

2. Reinvestment Rate Assumption

IRR assumes that all returns are reinvested at the same IRR. That’s not realistic for most of us. Would you really reinvest at 25%? Probably not.

3. Ignores Investment Size

Project A with 40% IRR on $1,000 earns you $400.

Project B with 12% IRR on $100,000 earns you $12,000.

Which is better? IRR doesn’t tell you that.

Enter MIRR: The Upgrade IRR Needs

That’s why we have MIRR—Modified Internal Rate of Return. It fixes a couple of IRR’s biggest issues:

- Assumes reinvestment happens at your cost of capital, not at IRR

- Solves the problem of multiple IRRs

You can calculate MIRR in Excel with:

=MIRR(values, finance_rate, reinvest_rate)

If your cash flows are wild or inconsistent, MIRR is your best bet.

So, When Should You Use IRR?

Here are some times when IRR is perfect for the job:

✅ Evaluating capital projects

✅ Comparing business investments

✅ Choosing between lease vs buy

✅ Judging long-term real estate deals

✅ Reviewing private equity returns

If you’re asking, “Is this investment worth it?”, IRR is a great place to start.

Quick Answers: IRR FAQs

What’s a “good” IRR?

In today’s world, anything above 10–12% is solid. But it depends on your industry and your required return.

Can IRR be negative?

Yep. That just means the investment is losing money.

IRR or NPV—Which is better?

Use both. IRR gives you the rate; NPV tells you the total value created.

How do I calculate IRR fast?

Use Excel. Just enter the cash flows and type =IRR(...).

What if my IRR equals my required return?

That means you’re breaking even. Not losing money, but not gaining much either.

Final Thoughts: IRR Isn’t Just for Finance Nerds

If you’ve made it this far—congrats. You now understand a concept that big investors, CFOs, and venture capitalists rely on all the time.

And the best part? You can use it, too.

IRR helps you decide where to put your money so it works harder for you. It’s not perfect—but it’s a solid guide when you’re comparing multiple options or trying to cut through the noise.

Next time you’re sizing up an investment, don’t just guess. Run the numbers. Use IRR. And make a smarter move.

Want to Take This Further?

Try opening up Excel, plug in a few cash flow scenarios, and experiment with the =IRR() function. You’ll get a better feel for how this works in real life—and maybe discover an investment that actually pays off.

Need an easy IRR calculator or visual? Let me know, and I’ll hook you up.