Selecting the ideal car insurance provider may seem daunting, yet this decision has major consequences that impact both your financial security and peace of mind on the road. No matter if you are new to driving or switching providers—understanding how to compare car insurance companies effectively is paramount for making informed and confident decisions. With this comprehensive guide at your side, making an informed decision becomes a little less daunting!

Selecting an appropriate car insurance provider requires more than finding a low premium; it means making sure that you have adequate protection in place to safeguard yourself, your passengers, and your vehicle in case of accidents or other unexpected incidents. Selecting the appropriate insurer could save money through discounts and comprehensive coverage options, whereas making the wrong selection could leave you exposed to significant out-of-pocket expenses or inadequate protection.

This guide’s purpose is to demystify the process of comparing car insurance providers by breaking it down into manageable steps. If you feel overwhelmed by all your options or simply don’t know where to start, this step-by-step approach will arm you with all of the knowledge and tools required for effective evaluation of different insurers.

We will cover everything from assessing your insurance needs and researching potential providers to gathering quotes, comparing coverage options, evaluating discounts, and eventually making an informed decision. By the time this guide concludes, you’ll have a roadmap to navigate the complexities of car insurance comparison and help make an informed decision.

Assess Your Insurance Needs

Determine Required Coverage

Before diving into comparisons, it’s crucial that you understand exactly which coverages you require. While each state may have differing legal requirements, beyond this foundational guidepost, your individual circumstances should help shape your choices.

- Liability Coverage: Liability coverage is mandatory in many states and provides protection from damages or injuries you cause others in an accident, including bodily injury and property damage liability. You should consider reviewing the minimum requirements in your state while also considering higher limits to better defend against possible lawsuits or high-cost claims.

- Collision Coverage: Collision insurance provides coverage for damages to your vehicle caused by an accident with another car or object regardless of who was at fault. Collision coverage is particularly useful if your car is newer and/or has higher repair or replacement costs; investing in collision coverage could save money in repair/replace costs over time.

- Comprehensive Coverage: Comprehensive coverage provides protection from non-collision related incidents such as theft, vandalism, natural disasters, and hitting an animal. It can be especially helpful in high-risk areas or for vehicles containing valuable parts.

Assess Optional Coverage

Beyond mandatory and basic types, additional optional coverage options exist which provide extra security and peace of mind.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you if involved in an accident with a driver who doesn’t carry adequate coverage—meaning damages or medical bills won’t fall on your shoulders alone.

- Personal Injury Protection (PIP): Personal Injury Protection is designed to cover medical expenses and lost wages incurred as the result of an accident, regardless of who caused it. PIP can be particularly helpful if your health insurance or liability coverage falls short, ensuring medical expenses don’t go unmet and that lost wages don’t accumulate over time.

- Roadside Assistance: When emergencies strike, roadside assistance services like towing, battery jump-starts, flat tire changes, and lockout assistance can be invaluable—adding value to your policy!

Consider Your Budget

Achieving optimal coverage by matching it to what’s affordable is key when selecting the ideal policy. Be mindful of premiums, deductibles, and out-of-pocket costs:

- Lower premiums may entail higher deductibles that could cost more if a claim arises.

- Higher premiums could offer reduced deductibles and comprehensive protection at lower upfront costs.

Assess your financial circumstances to find an acceptable balance between cost and coverage.

Research Potential Car Insurance Providers

Company Reputation

A provider’s reputation can have an enormous effect on your experience—be sure to take both customer feedback and industry ratings into consideration when making your selection.

Customer Reviews

A customer’s experiences provide invaluable insight into an insurer’s reliability and service quality. Platforms like Trustpilot, Yelp, and the Better Business Bureau offer user perspectives. Look for patterns in feedback concerning claims processing issues and customer service responsiveness.

Industry Ratings

Bodies such as J.D. Power and AM Best evaluate insurance companies on various criteria, such as customer satisfaction, financial strength, and claims handling. High scores from these entities signal the trustworthiness and stability of an insurer who will fulfill its commitments in full.

Assuring Financial Stability

Selecting an insurer with strong financial health is vital. A firm with this type of background is more likely to pay claims quickly and manage large-scale disasters efficiently.

Checking Financial Strength Ratings

Agencies like A.M. Best, Moody’s, and Standard & Poor’s provide ratings that indicate an insurer’s financial health. Look for companies with high ratings (e.g., A++ or AA) to ensure they can fulfill their commitments reliably.

Claims Handling

Efficient and fair claims management is at the core of good insurance service. Learn how various providers manage claims—how often they resolve them, the average resolution timeframes involved, and the overall process.

Research how quickly and fairly companies process claims. A provider with a reputation for fast, transparent claims handling can save time and hassle when filing one of your own.

Customer Service

Customer service that responds quickly and is helpful during stressful periods such as accidents or claims can make an enormous difference in outcomes.

Accessibility and Responsiveness

- Evaluate Customer Support Through Different Channels: Examine customer support availability across different channels such as phone, email, and live chat before conducting further evaluation.

- Determine Responsiveness: Reach out with questions or issues prior to making any commitments to gauge their responsiveness.

Acquire and Evaluate Quotes

Gather Necessary Information

To receive accurate quotes, it is necessary to provide comprehensive information. Consider:

- Personal Information: Age, gender, marital status, and address.

- Vehicle Details: Make, model, year, VIN number, mileage.

- Driving History: Number of years licensed, accidents or violations.

- Current Policy Information (if applicable).

Use Online Comparison Tools

Online comparison tools make the process of collecting multiple quotes more efficient by enabling you to enter your information once and receive quotes from different insurers simultaneously.

Advantages of Comparison Websites

Comparison websites save time and provide an in-depth view of available options, with websites like Compare.com, The Zebra, and NerdWallet offering user-friendly interfaces for comparing policies side-by-side.

Submit Request for Quotes

In addition to using comparison tools, consider reaching out directly to insurers for personalized quotes as this could yield better rates or reveal additional discounts not offered through comparison sites.

Understanding Quote Variables

Ensure that each quote meets your needs by fully comprehending what factors influence it—coverage levels, deductible amounts, and discounts available are just some of the variables to consider.

Compare Premiums and Deductibles

Evaluate cost differences between quotes by comparing premiums and deductibles. Although lower premiums might seem appealing, it’s crucial to consider how much of your own out-of-pocket payment would be necessary should a claim arise.

How Deductibles Affect Total Expenses

Higher deductibles tend to decrease your premium but increase out-of-pocket expenses when filing claims. Be mindful of both when choosing an insurer with high deductibles.

Analyze Coverage Options and Limits

Understand Policy Details

Review each policy’s specifics to fully comprehend what’s covered and what isn’t. Familiarize yourself with key terms and components to make accurate comparisons, and get acquainted with any comparison tables or tools available.

Breaking Down Policy Components

Examine what coverage types, limits, and additional features or riders your policy provides, as well as any extra features or riders that might be included.

Compare Coverage Levels

Different providers offer various levels of coverage, so be sure to assess which policy provides enough to meet your needs.

Identification of Gaps in Coverage

Ensure that there are no significant gaps in coverage that could leave you exposed to risks. For instance, some policies might exclude certain forms of damage or have lower liability limits than desired.

Review Exclusions and Limitations

Every policy comes with certain exclusions and limitations that define what is not covered, which can make filing claims much simpler and reduce surprises when they arise. Being familiar with these will save you both time and hassle in filing claims.

Check for Exclusions

Be vigilant for exclusions related to specific types of damage, usage restrictions, or driver requirements that might reduce coverage; such as accidents arising while using the vehicle commercially.

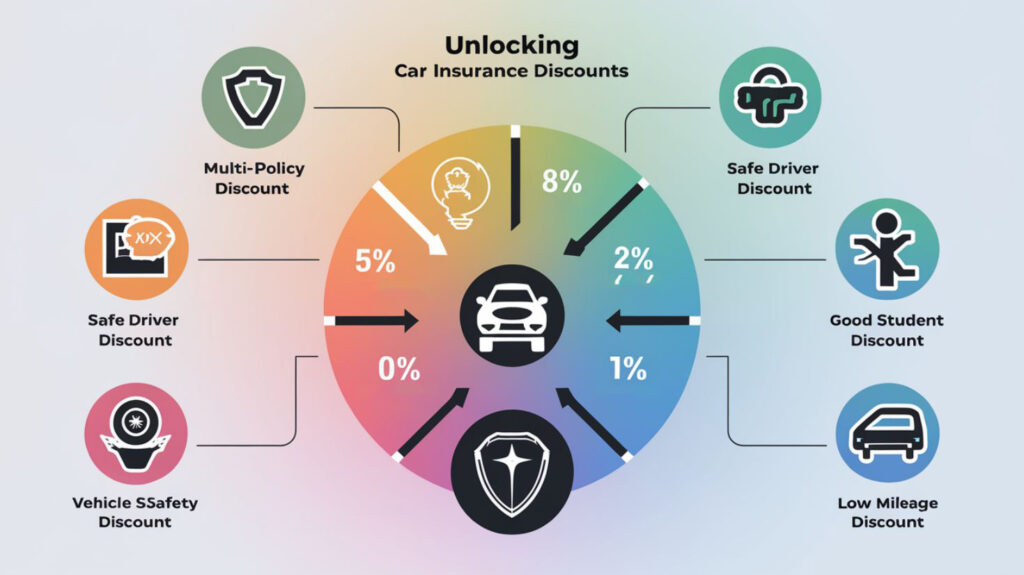

Explore Discount and Saving Opportunities

Bundling Policies

Bundling multiple policies together can yield substantial savings. Most insurers offer discounts when you consolidate multiple policies with them.

Benefits of Bundling

Not only can bundling save you money, but it also simplifies managing all your policies by dealing with just one provider.

Safe Driver Discounts

Upholding an impeccable driving record may qualify you for safe driver discounts, which reward those who have gone without accidents or traffic violations over a specified timeframe.

Potential Savings

A safe driver discount could lower your premium by as much as 25-30% depending on your insurer.

Good Student Discounts

Students with exceptional grades could qualify for a good student discount from insurers, offering reduced rates to those maintaining certain GPA levels—recognizing the correlation between good grades and responsible behavior, and strong academic achievement.

Requirements and Benefits

Typically, drivers with a B average or better can qualify for this discount and save money with it—making it a smart option for young drivers who want to get behind the wheel sooner rather than later.

Vehicle Safety Features

Cars equipped with antitheft devices, airbags, and advanced driver assistance systems (ADAS) may qualify for additional discounts.

Discounts for Safety Technology

These features reduce the risk of accidents and theft, allowing insurers to pass savings onto you as part of the savings package.

Other Available Discounts

Outside the standard discounts mentioned, there may be other opportunities for savings that suit your lifestyle and circumstances.

Examples of Additional Discounts

- Low Mileage Discounts: For drivers who do not utilize their car frequently.

- Military Service Discounts: For active or retired military members.

- Customer Loyalty Discounts: For long-term customers.

Think About Additional Features and Benefits

Mobile Apps and Online Account Management

Modern insurance providers offer digital tools that simplify customer experiences, making it easier to manage policies and access services.

Digitizing Your Policy for Convenience

Apps allow you to view policy details, make payments, file claims, and receive updates right from your smartphone—offering convenience and ease-of-use.

Roadside Assistance

Some insurers provide roadside assistance as an optional add-on or as part of their standard policies, giving drivers peace of mind knowing help is just a phone call away in times of emergency.

Services Offered and Their Value

Services available include towing, tire changes, fuel delivery, and lockout assistance—saving time and stress during unexpected breakdowns or accidents.

Accident Forgiveness

Accident forgiveness is an invaluable feature that prevents your first accident from increasing your premiums—an especially useful benefit for drivers prone to mishaps.

How it Works and Its Advantages

When an accident is forgiven, your premium remains unchanged, allowing for lower long-term insurance costs and long-term savings. This could bring great long-term stability.

Flexible Payment Plans

Flexible payment plans can make managing your insurance premiums simpler and more manageable. Look for an insurer that offers various payment schedules to accommodate your financial preferences.

Payment Options

Providers typically offer monthly, quarterly, semi-annual, and annual payment plans with automatic setup to avoid missed payments and potentially late fees.

Research State-Specific Requirements

Minimum Coverage Requirements

Car insurance requirements differ by state, with each establishing minimum coverage levels for liability, personal injury protection, and uninsured/underinsured motorist coverage.

Legal Requirements Vary by State

Any policy you purchase should meet or surpass the state-mandated minimum requirements to avoid legal penalties and provide adequate protection.

Additional State Mandates

Beyond minimum coverage requirements, some states impose additional insurance mandates that offer drivers extra protection or benefits.

Specific Insurance Mandates and Benefits

Certain states mandate drivers carry uninsured motorist property damage (UMPD) coverage or provide specific protections for certain vehicle models. It’s essential to understand these intricacies to ensure your policy complies with state mandates and provides sufficient protection.

Read Your Policy Carefully

Before making your final decision, it is imperative to read and fully comprehend all policy terms and conditions thoroughly to avoid surprises when filing claims.

Knowledge Is Key

Familiarize yourself with key aspects such as Coverage Limits, Exclusions, and the Claim Filing Process. Thorough knowledge can help prevent future disappointment by aligning expectations with policy offerings.

Cancellation Policies

Becoming familiar with an insurer’s cancellation policies can help avoid unexpected fees or complications if you decide to end your policy early.

Conditions Under Which Policies Can Be Canceled

Policies can often be canceled at any time; however, certain policies may impose fees or require advance notification. To avoid unnecessary costs, make sure that you know their terms prior to canceling them.

Renewal Terms

Insurance policies typically renew annually, and their terms can have an impactful effect on coverage and costs.

How Renewals Are Handled

Some insurers offer automatic renewals while others may reassess your rates based on changes to your driving record or other factors. Be mindful of how renewals are managed to avoid unexpected changes to your policy.

Make an Informed Decision

After collecting all the relevant information, it’s time to weigh the pros and cons of each insurance provider carefully. Consider factors like coverage options, costs, company reputation, and additional benefits before making a final decision.

Balance Coverage, Cost, and Provider Reputation

- Create a Prioritized List based on your individual needs and preferences.

- Compare Providers Objectively.

- Choose One that meets your requirements.

Select the Appropriate Insurer

Compare each insurer’s offerings against your assessed needs to select one that is the ideal match, taking care to select coverage at an affordable cost.

Match Insurer Offerings to Personal Needs

When choosing an insurer that best meets your personal requirements, be mindful of both current needs and any anticipated future modifications, such as buying a car or moving states, to find one who can adapt with changing circumstances.

Finalize Your Selection

Once you’ve identified a provider and selected an insurance plan, finalize it and begin paying premiums. This involves completing the application process and making your first payments.

Steps for Completing the Purchase

- Review the final policy details.

- Sign any required documents.

- Ensure you receive confirmation and documentation of your coverage.

- Verify all details are accurate, including how to reach out for support or file claims with your insurer.

Maintenance and Reviewing Your Insurance

Review Your Coverage

Over time, your needs for auto and homeowner’s insurance may change due to factors like buying a new car, moving house, or adapting driving habits. Reviewing coverage regularly ensures it remains adequate and cost-effective.

Importance of Periodic Assessments

Schedule annual reviews of your policy to adjust coverage levels, update personal details, and reassess needs. Doing this proactively will help ensure gaps in coverage don’t exist and that you take advantage of any discounts or policy options that arise.

Revamp Your Policy as Needed

Major life events such as marriage, purchasing a new vehicle, or adding teenage drivers can significantly affect your insurance needs.

Adjust Your Coverage After Major Life Events

Notify your insurer promptly of any significant life changes so they can adjust your policy appropriately, maintaining appropriate coverage levels and preventing issues when making claims.

Stay Informed on Industry Developments

Car insurance is an ever-evolving industry, subject to changing laws, regulations, and market trends.

Keep Abreast of Changes

Stay informed by:

- Subscribing to newsletters

- Following industry news

- Consulting with an insurance agent

- Reading industry publications

Staying abreast of changes allows you to take advantage of discounts, comply with regulations, and optimize coverage—being informed helps take the guesswork out.

Conclusion

Comparing car insurance providers requires taking a multistep approach: analyzing your needs, researching potential insurers, gathering quotes from each, comparing coverage options and discounts among them, considering any additional benefits, checking state-specific requirements, reading the fine print carefully, and making an informed decision.

Don’t let the complexity of car insurance comparisons put you off; use this guide as an aid to confidently navigate this process and select a provider who offers the optimal balance of coverage, cost, and service for your specific situation.

Additional Resources

To assist your search, consider taking advantage of online comparison tools, consulting insurance agents, or reading more in-depth articles on car insurance coverage issues. Resources like the National Association of Insurance Commissioners (NAIC) and consumer advocacy websites can provide further insights and advice.

Appendices

Glossary of Insurance Terms

Want to know more? Here is our glossary of insurance terms to make the comparison process simpler for you:

- Premium: Your payment for insurance policies on an ongoing or periodic basis; typically monthly or annually.

- Deductible: Out-of-pocket amount to pay before coverage kicks in.

- Liability Coverage: Covers any damages or injuries you cause others through negligence.

- Comprehensive Coverage: Insurance that protects against non-collision related damage to your vehicle.

- Collision Coverage: Coverage that covers damage incurred from an actual collision.

- Uninsured/Underinsured Motorist Coverage: Provides coverage if hit by someone with inadequate or no insurance policies.

Sample Comparison Chart

An insurer comparison chart is an effective way of visualizing differences among insurers. Here is a simplified example:

| Provider | Premium | Deductible | Liability Coverage | Collision | Comprehensive | Discounts Available |

|---|---|---|---|---|---|---|

| InsurePlus | $1,200 | $500 | $100,000 | Yes | Yes | Safe driver, multi-policy discounts |

| SafeDrive Insurance | $1,150 | $600 | $50,000 | Yes | Policy-specific | Reliable Coverage option available |

| Reliable Coverage | $1,300 | $400 | $100,000 | Yes | Yes | Y/N |

Checklist to Compare Car Insurance Providers

Utilize this checklist to ensure that all essential factors have been taken into consideration when comparing car insurance providers:

- Assess Your Insurance Needs

- Decide what coverage and options you need.

- Establish required and optional coverages.

- Plan your budget.

- Investigate Providers

- Evaluate company reputations, financial stability, claims handling, and customer service.

- Gather quotes.

- Collect Information

- Use online tools and request personalized quotes.

- Compare coverage and costs.

- Compare Coverages vs. Costs

- Examine premiums, deductibles, and coverage limits.

- Determine exclusions and limitations.

- Evaluate Discounts

- Explore available discounts and determine how to qualify.

- Consider additional features (add-ons).

- Ensure Compliance

- Make sure your state-specific requirements are met.

- Read and understand policy terms, cancellation, and renewal policies.

- Make an Informed Decision

- Weigh pros and cons.

- Confirm and finalize your policy for the best results.

With this comprehensive guide in hand, navigating the complex world of car insurance comparison should become much simpler and straightforward. Remember, the goal should not simply be finding the cheapest option but finding coverage that meets all your needs and provides reliable support when needed most.