Imagine a world where you can trade the same raw materials that fuel global economies—oil, gold, wheat, and even carbon credits. This is the world of the commodities market, where some of the most vital goods are bought and sold, shaping industries and impacting daily life.

The commodities market represents an aggregate of trading essential raw materials used for manufacturing, energy production, agriculture, and beyond. From farmers hedging against price drops to investors diversifying their portfolios, or companies managing supply chain risks, commodities trading assumes an important place in it all.

In this article, we’ll explore what commodities are, how they’re traded, and why they matter. We’ll also uncover the risks, strategies, and future trends in this fascinating market. Ready to dive into the heartbeat of the global economy? Let’s get started.

What is the Commodities Market?

The commodities market is a global platform where primary goods and raw materials are traded. There is a huge difference as compared to the stock market. While the latter deals with company shares, the commodity market deals with physical goods—this is the backbone of worldwide trade.

A Brief History

Trading in commodities dates back to thousands of years when ancient societies exchanged grain and livestock. The first formal commodity exchange is traceable to the 17th century Dojima Rice Exchange of Japan. Over time, markets such as the Chicago Board of Trade (CBOT) emerged, with structures in contracts that have enabled efficient trading.

Two Types of Commodity Markets

-

Spot Markets: In this market, commodities are traded for immediate delivery. This market is akin to a producer selling wheat to a consumer over the counter.

-

Futures Markets: In this market, traded contracts are entered into as an agreement of delivery of any commodity at an agreed-on price on some future date. Therefore, it has been commonly used for speculative purposes and to hedge risks.

The markets exist physically, for instance, exchanges, but also electronically making it accessible to all participants on Earth.

What Can Be Traded in the Commodities Market?

Commodities can be broadly classified into four categories, each crucial for different industries.

1. Agricultural Commodities

These consist of raw materials obtained through farming and ranching:

-

Grains: Wheat, corn, and rice are the most commonly traded commodities.

-

Soft Commodities: Coffee, sugar, and cocoa are very sensitive to weather and geopolitics.

-

Livestock: Cattle and hogs constitute an important portion of agricultural commodities.

2. Energy Commodities

Energy is a very valuable commodity in the economy. The commodities mentioned above are energy-driven.

-

Crude Oil: WTI and Brent crude oil form the largest share of this category.

-

Natural Gas: Used for heating and power generation.

-

Renewables: Ethanol and biodiesel are gaining prominence as sustainability gains importance.

3. Metals

Metals are divided into two categories:

-

Precious Metals: Gold and silver act as safe-haven assets during times of economic uncertainty.

-

Industrial Metals: Copper, aluminum, and nickel are used for construction and manufacturing.

4. Environmental Commodities

The emergence of sustainability has brought in:

-

Carbon Credits: Tradable permits for carbon emissions.

-

Water Futures: A reflection of the rising scarcity of fresh water.

With this diversity, commodities trading presents both risk management and profit-making opportunities.

How Does Commodities Trading Work?

Commodities trading involves buying and selling raw materials to take advantage of price movements or to hedge risks.

Key Players

-

Producers: Farmers, miners, and oil companies trade to ensure prices for their products.

-

Consumers: Organizations such as airlines or food companies employ commodities to source raw materials.

-

Traders and Speculators: These market participants seek to take advantage of changes in prices.

Trading Instruments

-

Futures Contracts: Agreements to purchase or sell a commodity at some point in the future and price.

-

Spot Trading: Direct sale or purchase for immediate delivery.

-

Options Contracts: Options give the buyer the right, but not the obligation, to buy or sell a commodity.

Exchanges

Huge commodity exchange entities, for instance, the New York Mercantile Exchange (NYMEX) and the Multi Commodity Exchange (MCX), have transparent and well-regulated dealings, thus ensuring liquidity with fair pricing.

Why Trade Commodities?

Trading commodities offers distinct benefits for investors and firms.

1. Diversification in Portfolios

A commodity can track independently of other stocks or bonds to hedge a portfolio.

2. Hedge Inflation

If inflation rises, commodity prices tend to increase as well, providing protection in purchasing power.

3. High Demand

Essential goods like oil and food ensure consistent demand, offering stable trading opportunities.

4. Leverage Opportunities

Traders can control large commodity positions with relatively small investments, magnifying potential gains.

These advantages make commodities a versatile tool for both professional traders and everyday investors.

Risks of Commodities Trading

While lucrative, commodities trading is not without its challenges.

1. Price Volatility

Prices can swing dramatically due to geopolitical events, natural disasters, or supply-demand imbalances.

2. Geopolitical Risks

Conflicts, trade embargoes, and political unrest typically throw commodity markets into turmoil.

3. Speculative Risks

Over-speculation causes price bubbles or collapses, which makes the market unpredictable.

4. Storage and Transportation

Physical commodities must be stored and transported, increasing costs and risks.

Knowing these risks is essential to successfully trading in the market.

Key Strategies for Commodities Trading Success

To succeed in commodities trading requires a combination of knowledge, analysis, and discipline.

1. Fundamental Analysis

Monitor supply-demand balances, weather patterns, and geopolitical events.

2. Technical Analysis

Charts, moving averages, and other methods to forecast price action.

3. Hedging

Futures can be used as a hedge against unfavorable price movements.

4. Diversification

Distribute investments across a variety of commodities to limit exposure.

How to Enter Commodities Trading

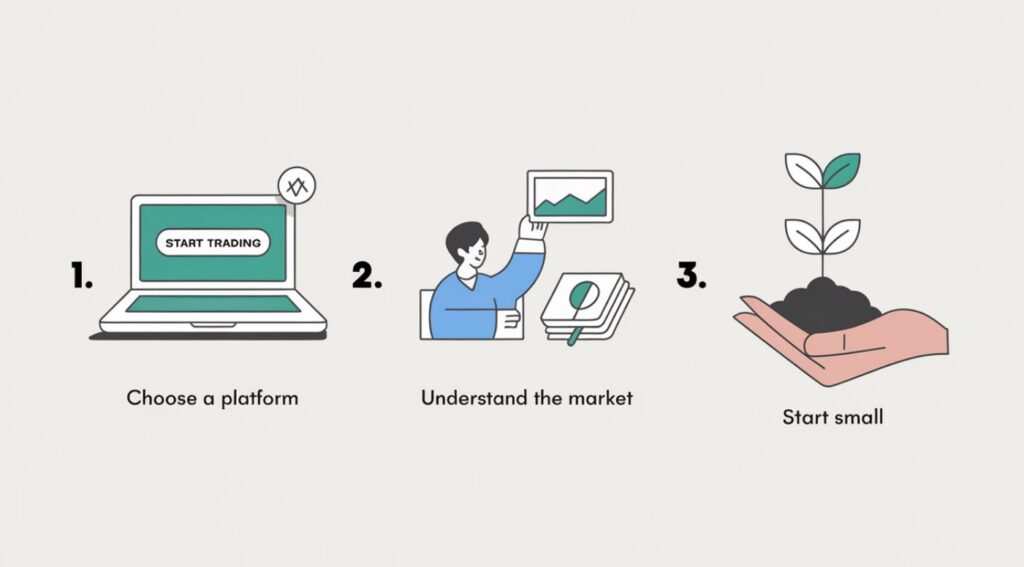

Digital platforms and online resources have made it easy to start trading commodities.

1. Select a Platform

Choose a broker or platform with low fees, easy interfaces, and educational resources.

2. Begin Small

Start by making smaller trades to learn how the markets work without significant capital exposure.

3. Educate Yourself

Monitor news and reports about the market to try to predict price changes.

4. Utilize Tools

Make use of trading apps and analytics tools to monitor your portfolio and identify trends.

Patience and continuous learning are what will help build your trading career.

Future of the Commodities Market

The commodities market is evolving, influenced by technology and changing global priorities.

1. Technological Advancements

Blockchain is revolutionizing transparency, while AI enables predictive analytics.

2. Sustainability Trends

Environmental commodities like carbon credits are gaining traction as nations focus on climate goals.

3. Emerging Markets

Growing economies in Asia and Africa are reshaping global demand patterns.

The future promises to be dynamic, offering new opportunities for savvy traders.

FAQs

What are the most traded commodities?

Crude oil, gold, and coffee are among the most actively traded commodities.

Is commodities trading risky?

Yes, but risks can be mitigated with proper strategies like hedging and diversification.

How much money do I need to start trading?

You can start with as little as $500, but it’s best to trade cautiously as a beginner.

What’s the difference between spot and futures trading?

Spot trading involves immediate transactions, while futures trading deals with contracts for future delivery.