International money transfer has become more common than ever in today’s interconnected world. Be it supporting a loved one back home, paying for overseas tuition, or investing in foreign markets, cross-border transactions play a very significant role in modern life. However, the cost of these transfers can vary dramatically depending on the timing. In other words, it allows you to know the determinants of the costs and make timely strategic decisions concerning when to send transfers. You would save much from this as outlined in this complete guide on when best to make an international money transfer and helpful hints on ensuring a cost-free, hassle-free transaction.

Understanding the Fundamentals

The Basic Understanding of International Money Transfers

Any kind of international money transfer requires understanding of the underlying process that determines both the cost and efficiency of a transaction. International money transfer involves converting one currency into another, sending funds across borders through networks of financial entities. This results in costs involved in exchange rate margins, bank fees, and intermediary charges.

Important Influencers of Transfer Costs

- Exchange rate: This is the price of exchange of a given currency for another. This is a major cost associated with remittances. It changes due to conditions prevailing in the market, economic factors, and political related issues.

- Charges: Banks and other operators charge transfer fees that may be constant transaction charges, percentage-based charges, or embedded fees in the exchange rate.

- Time Zones and Processing Times: In most cases, transactions that are initiated during working hours in the recipient country tend to process faster. However, transfers made during weekends or holidays may experience a delay.

Exchange Rate Insights: How and When to Get the Best Rates

Exchange rates are one of the most important factors in international money transfers. A small difference in rates can make a huge difference in the amount received by the beneficiary, especially in large transactions.

What Are Exchange Rates and Why Do They Fluctuate?

Exchange rates are the value of one currency compared to another. They are constantly changing due to factors such as:

- Economic Conditions: Inflation, interest rates, and economic growth affect the value of a currency.

- Market Sentiment: Political events, trade policies, and investor confidence can cause rapid shifts in exchange rates.

- Central Bank Policies: Decisions such as adjusting interest rates or intervening in currency markets can influence rates.

How to Monitor Exchange Rates

To secure the best rates, consider these strategies:

- Use online tools like XE, Wise, or OFX to track real-time exchange rates.

- Set up alerts for your desired rate to act quickly when conditions are favorable.

- Do not transfer money during times of high volatility, such as elections or economic crises.

Optimal Timing Strategies

Choosing the Right Day: When to Transfer for Optimal Savings

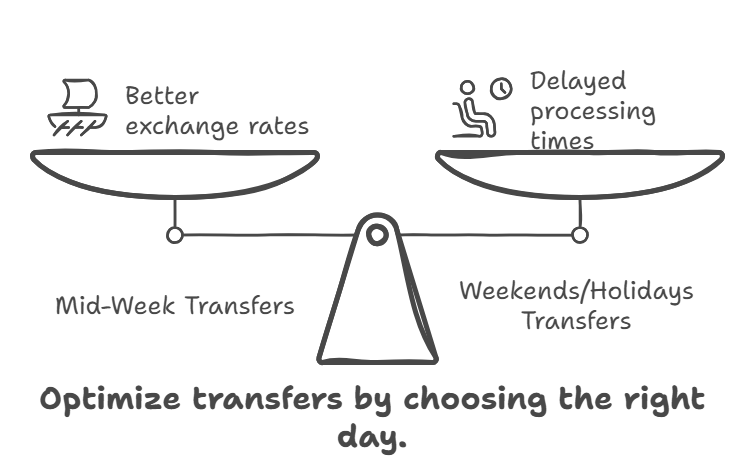

The day you choose to transfer money can influence the costs significantly. Although exchange rates change constantly, there are some patterns in the financial calendar that may help you optimize your transfers.

Mid-Week Advantage

Mid-week transfers, especially on Tuesdays and Wednesdays, tend to have better exchange rates and faster processing times. This is because currency markets are more active during these days, resulting in greater liquidity and tighter spreads.

Avoiding Weekends and Holidays

Most banks and other financial institutions have weekends and holidays in both countries. This might delay the processing of transactions when initiated during the weekends or on holidays, thus resulting in poorer rates due to lower market activities.

End-Of-Month vs. Mid-Month Transfers

Certain end-of-month periods often witness maximum financial activity as this is when businesses clear their accounts and most of the employees receive their salaries. Such high demand shoots minor fluctuations in the exchange rates. Mid-month transactions are less congested and may draw more favorable rates.

Timing According to Urgency

When Speed is the Priority

In emergencies, speed is often more important than cost. Western Union, MoneyGram, and PayPal are some of the services that can make near-instant transfers, but they charge higher fees and have less competitive exchange rates.

To minimize costs while ensuring speed:

- Choose a provider offering same-day transfer with transparent prices.

- Use high-speed services only when transferring small sums to minimize your exposure to these higher fees.

For Non-Urgent Transfers

Should you have sufficient time, then you can really plan your transfer:

- Monitor and wait for some favorable exchange conditions.

- Transfer when it’s the middle of the week and during their active trading periods.

- You could also open up a forward contract to lock at a good price for future transfers.

Global Market Considerations

How Global Market Hours Affect Transfers

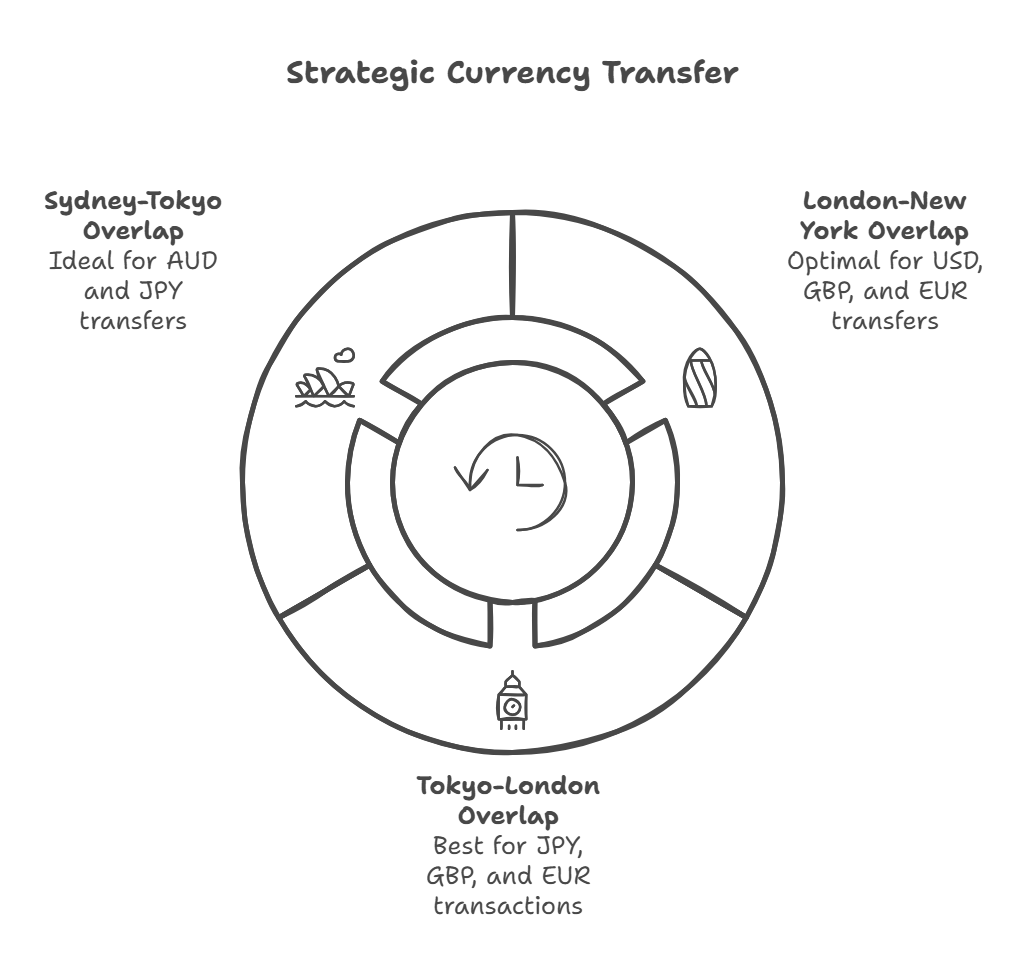

Currency markets are open 24 hours a day during weekdays due to the global nature of financial markets. However, not all hours are equal when it comes to liquidity and exchange rates.

Currency Market Overlaps

The best times to transfer money are usually when the major financial centers overlap their trading hours:

- London and New York Overlap (8 AM – 12 PM EST): High liquidity and better rates for USD, GBP, and EUR pairs.

- Tokyo and London Overlap (3 AM – 4 AM EST): Ideal for JPY, GBP, and EUR transactions.

- Sydney and Tokyo Overlap (7 PM – 2 AM EST): Best for AUD and JPY transfers.

Cost Management

Avoiding Hidden Costs and Delays

Hidden costs can quickly add up, making your transfer more expensive than anticipated. Being aware of these charges and knowing how to avoid them is crucial.

Common Fees to Watch Out For

- Bank Fees: Many banks charge high fees for international transfers, including fixed charges and percentage-based fees.

- Exchange Rate Margins: Some providers offer less competitive rates, embedding their profit margins into the exchange rate.

- Intermediary Fees: Most transfers via SWIFT networks are complete with fees added by intermediary banks.

Advanced Techniques for Regular Transfers

Hedging Tools

Forward contracts and limit orders let you lock in advantageous exchange rates for future transactions. These tools are particularly useful for businesses or individuals making recurring transfers.

Multi-Currency Accounts

Multi-currency accounts enable you to hold funds in different currencies, giving you the flexibility to transfer money when exchange rates are most favorable.

Popular Services for International Transfers

- Wise: Known for transparent fees and mid-market exchange rates

- Revolut: Multi-currency accounts, pretty competitive rates

- PayPal: Decent for small, quick transfer, but quite costly

- Western Union/MoneyGram: Pretty suitable for instant transfers but with less favorable rates

Pro Tips and Conclusion

- Set Rate Alerts: Use tools to get notified when exchange rates hit your desired level.

- Take Advantage of Promotions: Look for discounts or fee waivers from transfer services.

- Plan for Large Transfers: Time your high-value transactions to coincide with favorable market conditions.

Timing is everything. Knowing the exchanges, market overlap, and getting the right day and service to transfer money into another country would save you loads of money with smooth transactions at the end of it all. These tips and techniques will help the reader make educated decisions whether this is for a personal or a business reason and start monitoring rates and planning to take full control of international financial transfers.