Imagine spending months perfecting your SaaS, only to watch new sign-ups stall or free users hang around forever without paying a dime. Choosing how you let prospects try your product is one of the highest-leverage calls you’ll make. In 2025, two product-led offers dominate:

- Freemium – a forever-free tier with feature or usage limits.

- Free trial – full access for a short time, then pay or leave.

This deep-dive brings you real numbers—conversion rates, LTV, CAC—and fresh case studies so you can pick (or blend) the model that drives reliable, capital-efficient revenue.

Freemium vs. Free Trial at a Glance

| KPI | Freemium (median) | Free Trial 7-30 days (opt-in) | Free Trial 7-30 days (opt-out) |

|---|---|---|---|

| Visitor → Signup | 13.7 % | 7.8 % | 2.4 % |

| Free → Paid | 3 – 5 % | 18 – 25 % | ≈ 50 % |

| Typical LTV/CAC | 3 – 6 : 1 | 4 – 7 : 1 | 5 – 8 : 1 |

Takeaway: Freemium fills the top of your funnel faster and cheaper; free trials monetize fewer leads but at dramatically higher rates.

Deep-Dive: Freemium

Why Founders Love It

- Low marginal cost, massive reach. Slack’s forever-free tier helped it land 20 M+ daily users and convert roughly 30 % of active workspaces to paid plans.

- Network effects. Each free user can invite teammates, boosting viral acquisition at near-zero CAC.

- Self-serve revenue. A First Page Sage study finds a median 3.7 % free-to-paid rate, rising above 5 % in legal-tech and IoT niches.

Where It Bites Back

- Support load grows faster than revenue. You’ll field tickets from non-paying users unless you wall off live chat.

- Cash-flow lag. A 3 % conversion means 97 % of users produce no revenue today—hard on early-stage burn.

- “Free-rider” creep. Mailchimp’s 2025 move to strip automations from its free plan shows how rich free tiers can cannibalize upgrades.

2.3 Data-Driven Playbook

- Usage-based paywalls. Gate high-CPU or collaboration features once users reach a success milestone.

- Reverse trials. Let new sign-ups taste Pro features for 14 days, then drop to free—Canva credits this tactic for its surge past 220 M monthly users.

- In-app upgrade nudges. Time banners to “aha” moments (e.g., exporting a design, hitting message limits).

- Tier-based support. Self-help docs for free users, live chat for paid—keeps CS costs in line with LTV.

Deep-Dive: Free Trial

Strengths Backed by Numbers

- Higher intent, higher ARPU. Opt-in trials convert 18 – 25 % on average—4-6× freemium. Opt-out (credit-card-upfront) trials top 50 %.

- Predictable sales pipeline. A 30-day trial gives reps a fixed window to qualify, demo, and close.

- Faster payback. Median LTV/CAC of 5 : 1 beats freemium in most high-ACV niches.

Common Pitfalls

- Steep onboarding drop-off. Up to 80 % of trialists ghost after Day 1 if they don’t hit value fast.

- Higher CAC. You often need demos, emails, or even SDR calls to push trials to revenue.

Optimization Tactics You Can Steal

| Lever | What to Test | Why It Works |

|---|---|---|

| Trial length | 7 vs. 14 vs. 30 days | Shorter trials add urgency; longer trials help complex products show ROI. |

| Credit card required? | Card-upfront lifts conversion but slashes sign-ups. Evaluate CAC payback. | |

| Guided walkthroughs | Interactive checklists & tooltips drove 20 % lift for HubSpot’s Sidekick. | |

| Lifecycle email drips | Personalized “Day 1, 3, 7” nudges triple activation vs. generic blasts. |

Head-to-Head: Which Model Wins the KPIs That Matter to You?

| Scenario | Freemium Wins When… | Free Trial Wins When… |

|---|---|---|

| ARPU/ACV | <$50 mo., quick time-to-value | >$100 mo., multiple stakeholders |

| Virality Need | Network effects critical (chat, collab) | Low virality, high individual value |

| Cash Runway | >18 months runway | <12 months runway |

| Support Cost | Marginal costs near $0 | Need white-glove onboarding |

Break-even example: If your ARPU is $50 and CAC is $150, a 3 % freemium conversion yields $1.50 MRR per free user—payback in 100 days. A 20 % free-trial conversion yields $10 MRR—payback in 15 days.

Hybrid & Emerging Models

- Reverse Trial – Canva, ClickUp start users on a Pro trial, then downgrade.

- Usage-metered credits – AWS, Twilio hand out $200 credits instead of time limits.

- Seat-based land & expand – Slack’s paid features unlock when the whole team joins.

- Sunset Free Tier – Mailchimp and Heroku tightened free caps to fight “freemium fatigue.”

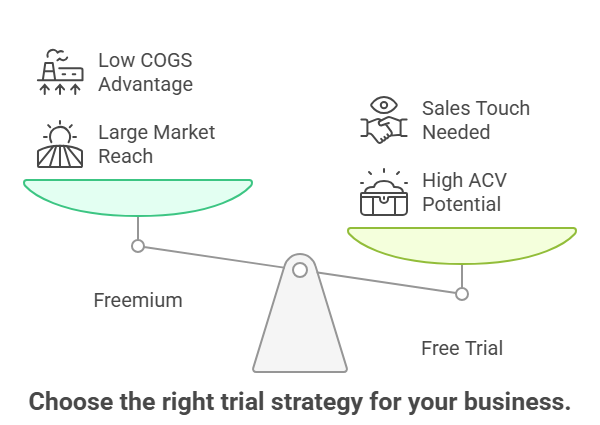

Decision Framework – Five Questions to Guide You

- What’s your average contract value? < $500/year often favors freemium.

- How complex is onboarding? More than 15 minutes? Trial with guided steps.

- Do network effects amplify value? Yes → freemium or hybrid.

- What’s your gross margin? Sub-80 % can’t afford hordes of free users.

- How long is your cash runway? Short runway → trial for faster payback.

Implementation Roadmap

- Set crystal-clear OKRs. Example: “Hit 20 % trial-to-paid by Q3.”

- Instrument leading indicators. Track Product-Qualified Leads (PQLs), not just sign-ups.

- Run continuous A/B tests. One hypothesis per sprint—pricing page, trial length, paywalls.

- Choose the right tooling. Mixpanel or Amplitude for event analytics, Pendo for in-app guides, HubSpot or Customer.io for drip emails.

- Align teams. Marketing drives top-funnel, Product owns activation, Sales assists high-value trials. A weekly “Growth Council” keeps everyone honest.

Measuring Success Over Time

- Cohort analysis. Compare Month 0-3 revenue from users who entered via freemium vs. trial.

- LTV projections. Use historical churn curves plus the Eqvista 2025 LTV benchmarks (healthy ratio ≥ 3 : 1).

- Causal impact tests. When you toggle models, track lift in ARR vs. control segment.

Common Mistakes (Skip These, Save Money)

- “Everything free” forever. Users stop seeing upgrade value.

- Asking for credit card too early. Kills activation if perceived risk is high.

- Neglecting onboarding. The best offer flops without a guided first-run experience.

- Scaling support before monetization. Keep human touch for paying customers; lean on docs and AI chatbots for free users.

Future Trends (2025-2030)

- AI-adaptive paywalls show premium banners only when propensity-to-buy spikes.

- Micro-trials. Two-hour “sandbox” sessions inside the live product.

- Community marketplaces. Users sell templates/plugins; platform takes a rev-share—extra LTV without raising prices.

- Regulation watch. EU Digital Markets Act may restrict dark-pattern opt-out trials; plan compliant flows early.

Conclusion – Data Beats Dogma

The real winners don’t swear fealty to freemium or free trials. They test, measure, and iterate until the numbers prove a model’s worth. Use the benchmarks and playbooks here, keep your CAC:LTV above 3:1, and you’ll scale without burning out—financially or mentally..

FAQ

Q1. What’s a “good” freemium conversion rate in 2025?

Around 3-5 % is solid; 6-8 % is world-class.

Q2. Should I require a credit card for my free trial?

Only if you can afford lower sign-up volume. Card-upfront boosts conversion to ~50 % but slashes trial starts to ~2 %.

Q3. How long should a SaaS free trial last?

Seven days for simple products, 14-30 for complex B2B tools. Test to find your activation sweet spot.

Q4. Can I run freemium and trials together?

Yes—reverse trials combine the reach of freemium and the urgency of a countdown clock.

Q5. How do I calculate LTV correctly for free users?

Segment by initial plan, apply historical upgrade and churn curves, then discount future cash flows.