Drowning in customer data but still guessing what actually moves the needle? You’re not alone. As CDP adoption rockets toward a projected $7.39 billion market size in 2025—and 72 percent of marketers already rely on a CDP to make sense of their data—the pressure to translate raw information into revenue has never been higher.

Below you’ll discover 10 practical, high-impact CDP use cases that any growth-minded team can lift off the slide deck and put to work. Each one includes why it matters, how to launch it, and which metrics prove it’s paying off.

CDP Basics in 60 Seconds

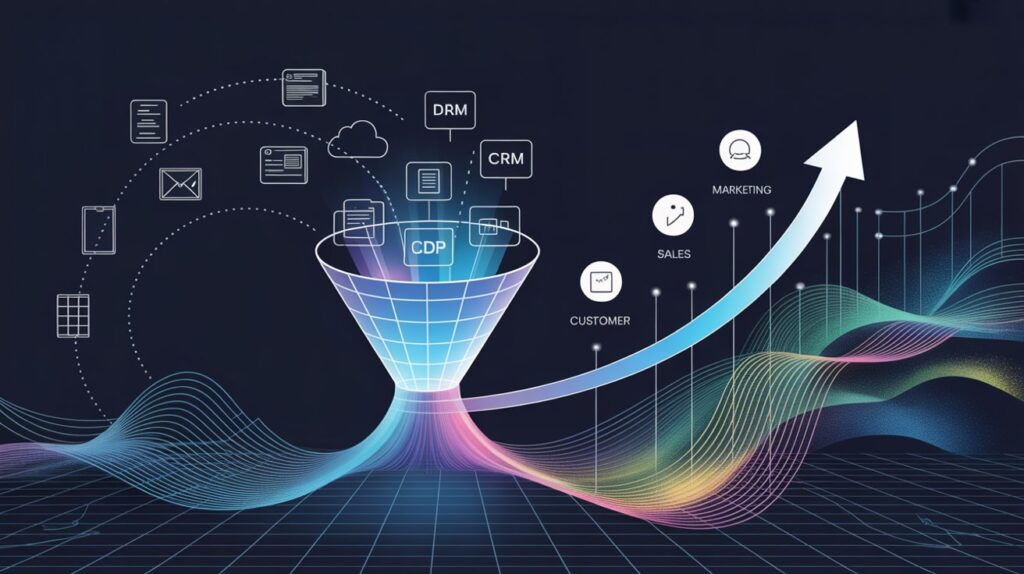

A Customer Data Platform is a centralized system that collects, cleans, and connects first-party customer data from every channel (web, mobile, email, POS, support, ads) into a single, persistent profile you can activate in real time.

| Tool | Primary Purpose | Key Difference vs. CDP |

|---|---|---|

| CRM | Manage known contacts & sales pipeline | Limited to logged-in or captured leads |

| DMP | Activate anonymous third-party audiences | Cookies expire; no persistent profiles |

| Marketing Automation | Orchestrate campaigns | Relies on whatever data source you feed it |

| CDP | Unify all data, keep it clean, push it anywhere | Foundation layer for every other tool |

Why it matters: Without that unified layer, every downstream tool fights with partial truths, leading to spend waste, disjointed journeys, and missed revenue.

Why CDPs = Growth Engines in 2025

- Unified profiles: See every click, chat, and purchase in one place.

- Real-time activation: Trigger messages the second a behavior happens.

- Privacy built-in: Central consent management helps you stay compliant even as cookies disappear.

- AI superpowers: Modern CDPs drop predictive scores and next-best actions right into your workflows.

- Composable stacks: Open APIs let you swap in new channels or AI models without rebuilding your data layer.

Bottom line: A CDP turns messy, scattered data into clarity you can cash in on.

How We Chose These Use Cases

We pored over analyst reports, vendor case studies, and first-hand interviews, ranking each use case by revenue impact, ease of launch, cross-functional value, and scalability. Only the game-changers made the cut.

The Top 10 Use Cases That Drive Growth

1. Single Customer View for Hyper-Personalization

What: Stitch every identifier—email, device ID, loyalty number—into a 360º profile.

Why: Personalized campaigns lift revenue per user 10–30 percent.

How:

- Map IDs across sources (web, app, POS).

- Resolve them via deterministic (email login) + probabilistic (device fingerprint) logic.

- Expose the profile to email, ads, and service apps via APIs.

KPIs: Average Order Value (AOV), click-through rate (CTR), profile match rate.

Mini-Case: A global apparel brand unified web and store data, then used location + size preferences to send local inventory alerts, boosting same-store sales 12 percent in one quarter.

2. Real-Time Omnichannel Orchestration

What: Trigger on-site, email, SMS, push, and ad messages from one decision layer.

Why: Customers who interact on 3+ channels spend 13 percent more per order (Harvard Business Review).

How:

- Connect near-real-time data streams (webhooks or streaming APIs).

- Build rules: “If cart value > $100 and user idles 10s, push exit-intent offer.”

- Use journey builder to set channel priority.

KPIs: Conversion rate, time to convert, cross-channel engagement rate.

Mini-Case: A DTC beauty brand cut cart abandonment 19 percent by firing a mobile push with a 5-minute countdown the moment a shopper closed the browser tab.

3. AI-Powered Predictive Segmentation & Propensity Scoring

What: Machine-learned models predict who will buy, churn, or upgrade.

Why: Targeting the highest-propensity 20 percent of leads can double paid media ROAS.

How:

- Feed historical purchase + engagement data to the CDP’s ML module.

- Auto-generate scores every 24 hours.

- Pipe “high-propensity” segment into ad platforms with bid multipliers.

KPIs: ROAS, cost per acquisition (CPA), uplift vs. control.

Mini-Case: A SaaS firm slashed trial-to-paid CPA 38 percent by bidding only on prospects with a >70 percent upgrade likelihood.

4. Dynamic Product Recommendations

What: Real-time, 1:1 product or content blocks on site, email, and in-app.

Why: Personalized recommendations drive up to 28 percent of Amazon’s revenue.

How:

- Train models on SKU interactions + customer affinities.

- Expose via API/widget; rank by margin or stock rules.

- A/B-test “trending,” “also bought,” vs. “for you.”

KPIs: Recommendation click rate, incremental revenue per session.

Mini-Case: An outdoor retailer swapped static emails for dynamic kits and saw a 17 percent higher AOV overnight.

5. Churn Prediction & Automated Retention Journeys

What: Score likelihood to churn; trigger save-a-sale offers.

Why: Retaining a customer is 5× cheaper than acquiring a new one.

How:

- Define churn (no order in X days, app uninstall).

- Train churn model; add score field to profile.

- Route high-risk customers into an email + SMS win-back flow.

KPIs: Churn rate, reactivation rate, customer lifetime value (LTV).

Mini-Case: A subscription meal company recovered 22 percent of “cancel” clicks by sending an instant SMS coupon.

6. Next-Best-Action (NBA) Messaging

What: Calculate the single message most likely to deepen value right now.

Why: Queueing one clear action instead of five random promos boosts click intent.

How:

- Combine predictive scores (churn, upsell) with real-time context (page view).

- Use rules engine or ML to rank actions.

- Pass NBA to channels via API variable.

KPIs: Action completion rate, incremental revenue per recipient.

Mini-Case: A telco increased add-on purchases 14 percent by recommending just the top add-on at log-in rather than a carousel.

7. Audience Suppression to Reduce Ad-Spend Waste

What: Remove existing customers—or recent site visitors—from prospecting and retargeting lists.

Why: Brands often waste 15–30 percent of paid spend on users who would have purchased anyway.

How:

- Sync daily buyer list to ad networks as “exclude.”

- Use on-site intent (e.g., “purchased in last 7 days”) for real-time suppression.

- Re-include when relevant (e.g., next-season launch).

KPIs: Media efficiency ratio, cost per incremental conversion, spend savings.

Mini-Case: A home-goods brand freed $2 million in annual ad budget, reinvesting it into upper-funnel video.

8. Privacy-First Preference & Consent Management

What: Capture, store, and honor each customer’s channel and data-sharing preferences.

Why: Fines for mishandling consent can reach $50,000 per violation (CCPA).

How:

- Embed a preference center powered by the CDP.

- Tag every outbound campaign with consent checks.

- Trigger re-permission flows before consents expire.

KPIs: Opt-in rate, complaint rate, compliance SLAs.

Mini-Case: A global publisher avoided six-figure fines after a new region rolled out strict consent laws—its CDP already handled geo-based consent logic.

9. First-Party Data Enrichment for Look-Alike Modeling

What: Feed richer seed audiences into ad networks to find new high-value users.

Why: Better seeds = better look-alikes, cutting acquisition costs up to 25 percent.

How:

- Build a “best customers” segment (top quintile LTV).

- Push anonymized attributes (not PII) to the network.

- Refresh seeds monthly.

KPIs: CPA, quality score of new users, early-life conversion.

Mini-Case: A fintech app used enriched demographic + behavioral traits and halved Facebook CPA within three weeks.

10. Cross-Sell & Upsell Triggers in B2B Account-Based Marketing

What: Combine firmographic, usage, and support-ticket data to spot expansion opportunities.

Why: Net revenue retention (NRR) above 120 percent is the hallmark of top SaaS performers.

How:

- Pull product-usage events into the CDP.

- Score accounts for “ready to expand.”

- Pass hot accounts to sales and auto-enroll contacts in nurture emails.

KPIs: Expansion ARR, deal velocity, NRR.

Mini-Case: A cybersecurity vendor saw a 31 percent faster upsell close rate when reps got daily “expansion-ready” lists.

Implementation Roadmap: From Business Case to Go-Live

- Audit Your Data: List every source and note gaps or compliance red flags.

- Align Stakeholders: Marketing owns activation, but IT, product, support, and legal all need seats at the table.

- Select or Build: Use a scorecard—must-haves (real-time API, consent module), nice-to-haves (native AI).

- Integrate & Test: Start with one or two channels; prove value early.

- Activate & Optimize: Use agile sprints to launch new use cases every 2–4 weeks.

Tip: Tie each sprint to a single, revenue-linked KPI so execs see the dollars.

Measuring Success: KPI Cheat-Sheet

| Use Case | Primary KPI | Secondary KPI |

|---|---|---|

| Single Customer View | AOV | Profile match rate |

| Omnichannel Orchestration | Conversion rate | Engagement rate |

| Predictive Segmentation | ROAS | CPA |

| Recommendations | Incremental revenue/session | Click rate |

| Churn Prediction | Churn rate | Reactivation rate |

| NBA Messaging | Action completion | Incremental revenue |

| Audience Suppression | Media efficiency | Spend saved |

| Consent Management | Opt-in rate | Complaint rate |

| Look-Alike Seeds | CPA | New-user LTV |

| B2B Expansion | Expansion ARR | NRR |

Common Pitfalls—and How You Dodge Them

| Pitfall | How to Sidestep It |

|---|---|

| Shiny-object syndrome (“Buy a CDP, magic happens”) | Draft a value hypothesis for each use case before signing a contract. |

| Integration underestimation | Budget time and resources for data mapping and QA, not just licensing. |

| Change-management blind spot | Train teams early; celebrate quick wins to drive adoption. |

Future-Proofing Your CDP Strategy

- Zero-party data: Let customers tell you their preferences up front.

- Gen-AI prompts: Feed unified profiles into LLMs for bespoke content at scale.

- Real-time synthetic cohorts: Use AI to create privacy-safe look-alikes without raw PII.

- Composable CDPs: Swap best-of-breed services (ID resolution, AI) without ripping out the core.

Action Checklist

Data clarity equals revenue clarity. When you funnel every click, tap, and purchase into a modern CDP and activate the 10 use cases above, you set your team up to grow faster, spend smarter, and serve customers better. Ready to begin? Start with this quick-start list:

- Pick one use case tied to a revenue metric.

- Audit the data sources needed.

- Set a 90-day sprint calendar.

- Share weekly KPI snapshots with stakeholders.

- Rinse, optimize, and layer in the next use case.

Want an expert eye on your data stack? Book a free 15-minute audit and spot your fastest wins.

FAQs

Q1. Can a CDP replace my CRM?

Not entirely. Think of the CDP as your unified data layer and the CRM as your sales execution layer. They complement each other when integrated.

Q2. How long does CDP implementation take?

A focused team can go live with a single use case in 90 days, but full orchestration typically spans 6–12 months.

Q3. What budget range should I expect?

SMB-friendly CDPs start around $30K/year. Enterprise platforms can exceed $500K, especially with high event volumes and premium AI add-ons.

Q4. Is a CDP still worth it after cookie deprecation?

Even more so. First-party data and consent management are becoming mission-critical as third-party cookies vanish.