Let me be straight with you—2026 is shaping up to be a challenging year for professionals who want to protect their businesses. Legal claims are rising, clients are more litigious than ever, and the gap between a cheap policy and the right policy has never been wider. If you’re reading this, you probably already sense that getting professional indemnity insurance isn’t just about ticking a compliance box anymore. It’s about survival.

You might be thinking, “I’ll just grab the cheapest quote and move on.” Here’s why that’s a dangerous mistake. The global professional indemnity insurance market hit $5.5 billion in 2024, and claims in India alone have risen 6% over just two years. More importantly, defense costs are climbing while insurers are becoming pickier about what they’ll cover. That rock-bottom quote you’re eyeing? It might leave you bankrupt when you actually need it.

This guide is written for you—whether you’re a freelancer working from your home office, a consultant flying between client meetings, an agency owner managing a team, or a startup founder wearing too many hats. I’ll walk you through exactly how to get quotes that actually protect you, not just policies that look good on paper.

What Is Professional Indemnity Insurance?

Let’s cut through the insurance-speak. Professional indemnity insurance (PI) is your financial shield when a client claims your work cost them money. Simple as that.

Here’s a real example: You’re a marketing consultant who recommended a PPC campaign. The client spent ₹50 lakh based on your projections, but the campaign flopped. Now they’re suing you for the lost investment. Your PI insurance steps in to cover legal defense costs and any settlement—potentially saving your business.

What PI Insurance Covers vs What It Doesn’t

It covers:

-

Negligence claims (honest mistakes that cost clients money)

-

Legal defense costs (lawyer fees, court costs)

-

Document loss situations

-

Breach of confidentiality

-

Claims made during your policy period, even for work done years ago (if you have retroactive coverage)

It doesn’t cover:

-

Criminal acts or intentional wrongdoing

-

Property damage or bodily injury (that’s general liability)

-

Employee injuries (that’s workers’ compensation)

-

Cyber attacks (you need separate cyber insurance for that)

Professional Indemnity vs General Liability vs Cyber Insurance

Think of these as three separate locks on your business door:

-

PI Insurance: Protects against financial losses from your professional advice or services

-

General Liability: Covers physical injuries or property damage at your office

-

Cyber Insurance: Protects against data breaches and digital attacks

In 2026, with remote work and digital services booming, you likely need all three. But PI is the foundation—it’s what most clients check for first.

Who Needs Professional Indemnity Insurance in 2026?

If you provide advice, services, or expertise for a fee, you need PI insurance. Period. But let me break down the specific scenarios:

Freelancers and Independent Professionals

You’re not too small to be sued. In fact, freelancers are increasingly targeted because clients assume you don’t have insurance. A single claim can wipe out your savings. If you’re a freelance designer, writer, developer, or consultant, you need coverage starting at ₹5-10 lakh minimum.

Consultants (IT, Marketing, Management, Finance)

Your recommendations directly impact client revenues. An IT consultant’s faulty system recommendation or a financial advisor’s investment strategy that underperforms can trigger six-figure claims. The complexity of your advice means you need higher limits—typically ₹1-5 crore.

Agencies and Service-Based Businesses

With multiple employees and larger clients, your risk multiplies. One junior employee’s mistake can cost you everything. Agencies need coverage that scales with team size and client contract values.

Regulated Professions and Contract-Required Coverage

Doctors, lawyers, architects, and accountants often legally require PI insurance. But even if it’s not legally mandated, most client contracts now include insurance requirements. I’ve seen freelancers lose ₹30 lakh contracts because they couldn’t prove adequate coverage.

When It’s Legally Required vs Contractually Required

Legally required: Medical professionals, lawyers, financial advisors in many jurisdictions

Contractually required: Most B2B service agreements, government contracts, enterprise clients

Smart business practice: Even when not required, if you have clients, you have exposure

What Affects Professional Indemnity Insurance Quotes?

Insurance companies have gotten sophisticated about pricing risk. Here’s exactly what they’re looking at when you request a quote:

Your Profession and Risk Level

Insurers categorize professions into risk tiers:

-

High-risk: Medical practitioners, financial advisors, architects, engineers (premiums 2-4x higher)

-

Medium-risk: IT consultants, lawyers, accountants

-

Low-risk: Marketing consultants, designers, writers

Why the difference? A surgeon’s error can cause permanent disability. A graphic designer’s error means a reprint. The potential financial impact drives pricing.

Coverage Limit Chosen

This is where most people get confused. Higher limits don’t always mean proportionally higher premiums. Here’s real data from Hiscox UK: cover for £250,000 might cost £400 annually, while £1,000,000 cover costs £600—just £200 more for an additional £750,000 in protection.

Recommended limits by profession:

-

Freelancers: ₹10-25 lakh

-

Consultants: ₹50 lakh-2 crore

-

Agencies: ₹2-10 crore

-

High-risk professionals: ₹5-20 crore

Claims History

Your past is the best predictor of your future—at least that’s what insurers believe. Multiple or severe claims can increase premiums by 50-200%. A clean claims history can unlock discounts of 10-30%.

Claims stay on your record for 5-6 years. Even small claims matter—three minor claims suggest a pattern that makes insurers nervous.

Business Size and Revenue

Your annual revenue directly correlates with risk exposure. Why? Bigger clients mean bigger potential losses. A consultant earning ₹50 lakh annually faces different risks than one earning ₹5 crore. Insurers use your turnover to estimate potential claim sizes.

Coverage Scope and Add-Ons

Worldwide cover: Essential if you have international clients, but adds 15-30% to premiums

Retroactive cover: Protects past work, crucial for established businesses. Can add 20-50% but worth every rupee

Legal defense costs: Some policies include this in the limit, others provide separate coverage. Always confirm

How to Get the Best Professional Indemnity Insurance Quotes Online

Here’s my proven five-step process for getting quotes that actually protect you:

Step 1 – Know Your Exact Coverage Needs

Before you click “get quote,” answer these questions:

-

What’s the largest contract value you handle? (Your coverage should be at least 2-3x this amount)

-

Do your contracts specify minimum coverage requirements?

-

Do you need worldwide coverage?

-

How far back does your work go? (You’ll need retroactive coverage)

Avoid over-insuring: A freelance writer doesn’t need ₹5 crore coverage. That’s wasted money.

Avoid under-insuring: An IT consultant handling ₹2 crore projects with only ₹10 lakh coverage is exposed.

Step 2 – Use Multiple Quote Comparison Platforms

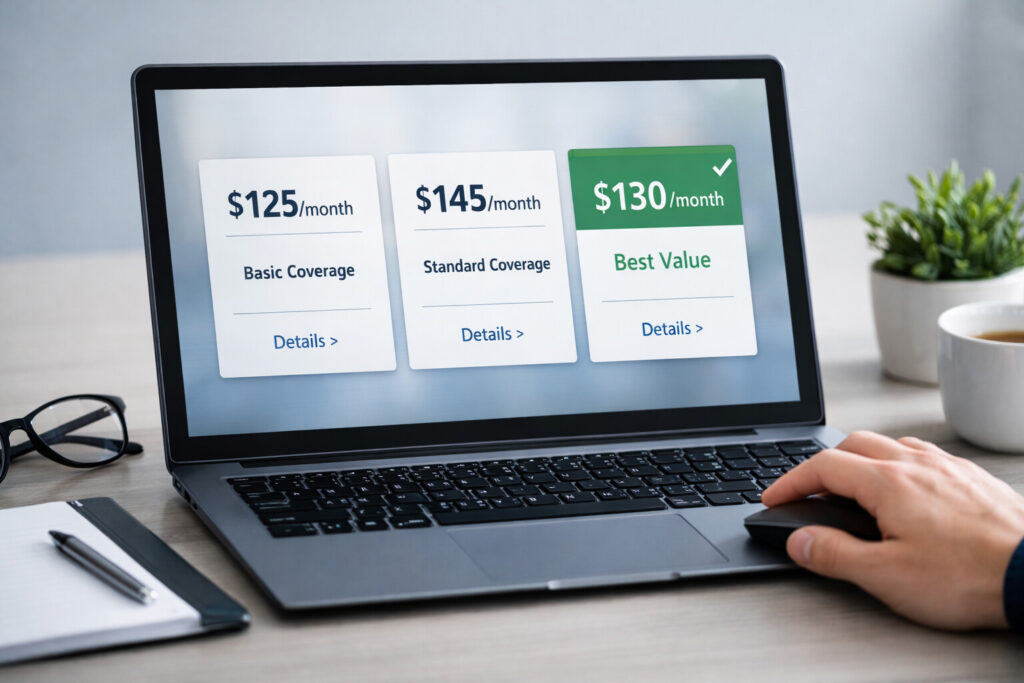

Getting one quote is like buying the first car you see. You need options. Here’s the reality: different insurers specialize in different professions. The company offering great rates to architects might charge consultants double.

Broker vs Direct Insurer Comparison:

-

Brokers (like BimaKavach, Mitigata): Compare multiple insurers, provide expert advice, handle claims support

-

Direct insurers: Faster quotes, but you’re on your own if issues arise

In 2026, I recommend using at least 3 comparison platforms. Indian professionals should check PolicyBazaar, BimaKavach, and Mitigata. UK/US professionals should use MoneySuperMarket, Simply Business, and commercial brokers.

Step 3 – Provide Accurate Information

This is where honesty saves you money. Misrepresenting your revenue, employee count, or claims history might get you a lower quote initially, but insurers will void your policy when you claim if they find discrepancies.

Common mistakes that inflate quotes:

-

Overstating revenue (insurers verify this)

-

Forgetting to mention past claims (they’ll find them)

-

Underreporting employee count

-

Downplaying high-risk activities

Pro tip: Gather your financial statements, client contract samples, and claims history before starting applications. This ensures accuracy and saves time.

Step 4 – Compare More Than Just Price

The cheapest quote is rarely the best. Here’s what to evaluate:

Policy wording: Read the exclusions section carefully. One policy might exclude “contractual liability” while another covers it.

Exclusions and sub-limits: Some policies have sub-limits for legal defense costs or exclude certain claim types entirely.

Claim handling reputation: Research insurer reviews on claims payment speed. A company that fights every claim will cost you in stress and legal fees.

Coverage ratio options: Understand AOA (Any One Accident) vs AOY (Any One Year) limits. A 1:4 ratio means one claim can use up 25% of your annual limit.

Step 5 – Negotiate and Customize Your Policy

Yes, you can negotiate insurance. Here’s how:

-

Adjust deductibles: Increasing your deductible from ₹50,000 to ₹1 lakh can reduce premiums by 10-20%

-

Remove unnecessary add-ons: Don’t pay for worldwide coverage if all your clients are local

-

Bundle policies: Many insurers offer 10-15% discounts if you buy PI, general liability, and cyber together

-

Pay annually: Monthly payments often include 5-10% financing charges

Average Professional Indemnity Insurance Costs in 2026

Let’s talk real numbers. Insurance costs vary dramatically by location and profession, but here are the ranges you should expect:

Typical Annual Costs by Profession

| Profession | Annual Revenue | Coverage Limit | Annual Premium (India) | Annual Premium (UK) | Annual Premium (US) |

|---|---|---|---|---|---|

| Freelance Writer | ₹5-10 lakh | ₹10 lakh | ₹8,000-15,000 | £96-180 | $383-550 |

| Marketing Consultant | ₹20-50 lakh | ₹25 lakh | ₹20,000-40,000 | £300-500 | $600-900 |

| IT Consultant | ₹50 lakh-2Cr | ₹1 crore | ₹50,000-1,20,000 | £500-800 | $900-1,500 |

| Financial Advisor | ₹1-5 Cr | ₹2 crore | ₹1,00,000-3,00,000 | £800-1,500 | $1,500-3,000 |

| Medical Practitioner | ₹2-10 Cr | ₹5 crore | ₹3,00,000-8,00,000 | £2,000-5,000 | $3,000-8,000 |

| Architect/Engineer | ₹1-10 Cr | ₹5 crore | ₹2,00,000-6,00,000 | £1,500-4,000 | $2,500-7,000 |

Freelancers vs Small Businesses vs Agencies

Freelancers: Expect ₹8,000-50,000 annually. Your low overhead means lower risk, but don’t skip coverage. One claim can exceed your annual premium by 10x.

Small Businesses (1-10 employees): Budget ₹50,000-3,00,000 annually. As you add employees, premiums rise because each person represents additional risk.

Agencies (10+ employees): Plan for ₹2,00,000-10,00,000+ annually. At this size, you need higher limits and should consider separate policies for different service lines.

Monthly vs Annual Payment Cost Differences

Most insurers charge 5-15% more for monthly payments. On a ₹75,000 annual premium, monthly payments might cost ₹6,750/month (₹81,000 total) versus ₹75,000 if paid annually. That’s ₹6,000 you could save.

Cheap vs Comprehensive Quotes – What Should You Choose?

Let’s address the elephant in the room: cost versus coverage. I know you want to save money. We all do. But with PI insurance, cheap can be devastatingly expensive.

Risks of Ultra-Cheap PI Insurance

That ₹5,000/year policy looks tempting until you read the fine print:

-

Exclusions for contractual liability: If your client contract includes specific guarantees, you’re not covered

-

Defense costs within the limit: A ₹10 lakh policy with ₹8 lakh in legal fees leaves only ₹2 lakh for settlement

-

No retroactive cover: That project you finished last month? Not covered

-

High deductibles: You pay the first ₹2 lakh of any claim

When Skimping on Exclusions Can Cost More Later

Here’s a real scenario: You’re a consultant with a ₹50,000 premium policy that excludes “consequential losses.” You advise a client to change suppliers, but the new supplier fails, costing the client ₹20 lakh in lost revenue. Your policy refuses to pay because it’s a consequential loss. You’re now personally liable for ₹20 lakh.

The ₹75,000 policy that included consequential losses would have covered this. You “saved” ₹25,000 but risked ₹20 lakh.

How to Balance Affordability and Protection

The sweet spot is buying the most coverage you can reasonably afford, not the least you can get away with. Follow this formula:

-

Calculate your maximum potential exposure (largest contract × 3)

-

Get quotes for that limit plus one level higher

-

Compare the price difference

-

If the jump is less than 25% of the lower premium, take the higher coverage

Common Mistakes to Avoid When Getting Quotes Online

I’ve seen professionals make these mistakes repeatedly. Learn from their errors:

Choosing Lowest Price Without Reading Exclusions

The #1 mistake. That ₹15,000 policy saves you ₹10,000 upfront but might exclude the exact risk that sinks your business. Always read the exclusions section before buying.

Ignoring Retroactive Date

If you’ve been in business for 3 years and get a policy with no retroactive coverage, you’re unprotected for those 3 years of past work. Claims can emerge years after project completion. Always ensure your retroactive date matches your business start date or your first PI policy date.

Underestimating Revenue or Client Risk

Insurers audit claims. If you claim ₹20 lakh revenue but your tax returns show ₹50 lakh, they’ll void your policy for misrepresentation. Be accurate, even if it costs more.

Skipping Legal Cost Coverage

Some cheap policies include defense costs within your overall limit. This means a ₹10 lakh policy with ₹8 lakh in legal fees leaves only ₹2 lakh for settlement. Always confirm defense costs are covered separately or in addition to your limit.

How to Lower Your Professional Indemnity Insurance Quote Legally

You don’t have to pay full price. Here are legitimate ways to reduce your premium:

Improving Risk Management

Insurers reward good practices. Implement these and mention them when getting quotes:

-

Written contracts with clear limitation of liability clauses

-

Documented quality control processes

-

Employee training programs with records

-

Centralized digital record keeping

-

Client communication protocols that manage expectations

These can reduce premiums by 10-20%.

Choosing the Right Excess (Deductible)

Increasing your excess from ₹50,000 to ₹1 lakh can reduce your premium by 10-20%. But be realistic—choose an excess you can actually afford to pay if a claim happens. A ₹5 lakh deductible that saves you ₹15,000 annually isn’t worth it if you can’t pay the deductible when needed.

Bundling Policies

If you need general liability, cyber insurance, or other business coverage, buy from the same insurer. Multi-policy discounts typically range from 10-15%. More importantly, having one insurer handle all claims prevents disputes about which policy covers what.

Annual Payment Discounts

Paying annually instead of monthly saves the financing charges most insurers add. On a ₹75,000 policy, this can save you ₹3,750-7,500. If cash flow is tight, consider if the savings justify the one-time payment.

Maintaining a Clean Claims History

This is the long game. One year without claims might save you 5-10%. Five years clean can unlock 20-30% discounts. Some insurers offer “claims-free” bonuses that permanently reduce your base rate. If you have a minor issue that could become a claim, sometimes paying out-of-pocket for a fix is cheaper than the long-term premium increase.

Professional Indemnity Insurance Quotes for Freelancers vs Businesses

The quoting process and pricing differ significantly based on your business structure. Understanding these differences helps you get appropriate coverage.

Key Differences in Pricing

Freelancers typically receive quotes based on:

-

Personal revenue only

-

Lower coverage limits (₹10-50 lakh)

-

Simplified application process

-

Premiums: ₹8,000-50,000 annually

Businesses face quotes based on:

-

Total company revenue

-

Employee count (each person increases risk)

-

Higher required limits (₹1-10 crore)

-

More detailed underwriting

-

Premiums: ₹50,000-10,00,000+ annually

Coverage Features Freelancers Often Miss

Freelancers frequently skip these crucial elements:

-

Retroactive coverage: Your past work needs protection too

-

Run-off coverage: If you stop freelancing, claims can still emerge. Run-off coverage protects you for 3-6 years after you cease trading

-

Sub-contractor coverage: If you hire other freelancers, ensure your policy covers their errors

-

Contractual liability: Many freelance contracts include specific guarantees. Standard policies might exclude these

Scaling Coverage as Your Business Grows

Your insurance should grow with you. Set calendar reminders to review coverage when:

-

Revenue increases by 50%

-

You land a client 3x larger than your previous largest

-

You hire your first employee

-

You expand service offerings

Most insurers let you adjust mid-term, though premium changes may be prorated. Better to increase coverage proactively than discover you’re underinsured after a claim.

FAQs About Professional Indemnity Insurance Quotes

How Fast Can I Get Quotes Online?

Most comparison platforms provide quotes within 5-15 minutes if you have all information ready. Direct insurer applications take 10-30 minutes. Complex businesses might need 24-48 hours for underwriter review.

Can I Switch Insurers Mid-Policy?

Yes, but it’s usually not cost-effective. You’ll lose the remaining premium and pay a new policy’s full cost. Additionally, your new policy’s retroactive date might create a coverage gap for past work. It’s generally better to switch at renewal.

Are Online Quotes Reliable?

Online quotes are estimates, not guarantees. The final premium comes after the insurer reviews your full application and documents. Discrepancies between your stated and verified information can change the price. However, online quotes are typically accurate within 10-15% if you’re honest and thorough.

Does PI Insurance Cover Past Work?

Only if you have retroactive coverage with a date that includes that work. If you had continuous PI insurance, your new policy should match your first policy’s start date. If you’re buying PI for the first time after years in business, past work is unprotected unless you specifically buy retroactive coverage—which many insurers won’t offer for established businesses.

Is Professional Indemnity Tax-Deductible?

Yes, in most jurisdictions including India, the UK, and US, PI insurance is a legitimate business expense deductible from taxable income. Keep premium payment receipts and policy documents for tax records.

Final Checklist Before You Buy a Quote

Before clicking “buy,” run through this checklist:

✓ Coverage limits confirmed

-

Matches or exceeds your largest contract × 2

-

Meets client contract requirements

-

Appropriate for your industry standards

✓ Exclusions reviewed

-

Read the entire exclusions section

-

No surprise exclusions for your specific services

-

Contractual liability included if needed

✓ Retroactive date checked

-

Matches your business start date or first PI policy date

-

Covers all past professional work

-

No gaps in coverage history

✓ Legal defense included

-

Defense costs covered separately from policy limit

-

Or additional limit specifically for defense costs

-

No sub-limits that could exhaust coverage

✓ Policy matches client contracts

-

Coverage limit meets contract requirements

-

Insurer rating acceptable to clients

-

Certificate of insurance format matches client needs

✓ Insurer financial stability

-

Check insurer’s claim settlement ratio

-

Read recent reviews about claims handling

-

Confirm they specialize in your profession

✓ Premium payment terms

-

Annual payment discount factored

-

Payment date works with your cash flow

-

No hidden fees or charges

Conclusion: How to Secure the Best Professional Indemnity Insurance Quote in 2026

Let me leave you with this: The best professional indemnity insurance quote isn’t the cheapest—it’s the one that lets you sleep at night knowing you’re protected.

Your smart buying strategy is simple:

-

Assess accurately: Know your real exposure based on contract values and client types

-

Compare thoroughly: Use multiple platforms and compare more than price

-

Read carefully: Understand exclusions, retroactive dates, and defense cost coverage

-

Negotiate confidently: Adjust deductibles, bundle policies, and ask about discounts

-

Review annually: Your business changes—your insurance should too

The difference between informed comparison and impulse buying could be the difference between your business surviving a claim or closing its doors. In 2026, with rising litigation and increasingly complex client relationships, professional indemnity insurance isn’t optional—it’s essential business infrastructure.

Don’t let the research overwhelm you. Start with getting 3 quotes today using the steps in this guide. Spend the time now to get it right, and you’ll thank yourself when (not if) a client dispute arises.

Your business is worth protecting properly. Now go get quotes that actually protect you.