Despite evolving trends and the race for targeted audiences, Facebook (Meta) remains one of the “Big Four Tech Companies,” serving as one of the most prominent advertising platforms globally. The platform safeguards its users and advertisers from fraudulent activities. To achieve this, specialized systems and algorithms monitor not only content but also account behavior and advertisers’ payment methods. In cases of suspicious activity, Meta’s anti-fraud systems block payments, flagging them as “Risk Payments.”

This article aims to explain what risk payments are, why they occur, and how to avoid them.

Risk payment: what it is and why it matters

How does Facebook verify payments?

Facebook employs robust security systems to scrutinize payment methods. These measures aim to protect the platform and its users from fraud and financial losses. The technical payment process on Facebook is complex, involving multiple stages of verification for the payment method and ad account. The compatibility between these elements, payment history, and account activity is thoroughly assessed.

The entire verification process is automated, leveraging artificial intelligence, machine learning, rules engines, anomaly detection systems, and other technologies.

Payments on Facebook undergo several stages of verification. First, the system validates the credit or debit card, checking whether it is functional and meets Facebook’s standards, as well as reviewing its prior usage. Specialized virtual cards for Facebook Ads are often used to increase the chances of passing this stage. The system also evaluates the actions and activity of the advertising account, including its geographical location, and compares the payment method data with the account details. Finally, the system assesses the risks associated with the transaction.

What is a risk payment?

If the system detects any discrepancies or identifies actions that could be classified as suspicious or risky at any stage of the verification process, the payment is blocked and labeled as a “Risk Payment.”

Risk Payment is a payment status that signals an issue with the transaction. It is automatically assigned by Facebook’s security systems during the payment verification process. Transactions with this status are immediately blocked.

It’s important to understand that a Risk Payment status can lead not only to the blocking of the payment or payment method but also to the suspension of the account itself.

Consequences of ignoring risk payments

Risk Payments can result in two major issues for advertisers, which are interrelated and can adversely affect both performance and operations:

- Financial Loss: The halt of an entire advertising campaign due to unpaid bills, leading to financial setbacks

- Reputation Damage: Blocked ad accounts signal a lack of professionalism on the advertiser’s part

These problems become more severe if risk payments occur frequently and advertisers fail to address them. To pass Facebook’s security checks and minimize the consequences of Risk Payments, it’s essential to understand why a payment might fail verification on the platform.

Causes of risk payments: suspicious actions, error classifications and practical tips

Actions Meta considers suspicious

The reasons for payment blocks on Facebook are varied. Risk Payments often occur due to payment methods failing verification. However, this issue can be almost entirely resolved by selecting an optimal payment method. Other causes depend on advertiser behavior and the specific mechanisms of Meta’s verification systems.

Here are some actions that Meta’s system may classify as suspicious:

- Use of Unusual Cards or Payment Platforms: Facebook’s verification systems pay close attention to cards from lesser-known banks or those issued in countries with high fraud rates. Certain virtual cards without physical issuing banks may also be unsuitable for Facebook Ads.

- Frequent Changes to Payment Methods: Adding multiple new cards or accounts can be seen as an attempt to bypass platform restrictions.

- Sudden Account Behavior Changes: Significant changes in ad spending or campaign settings can raise red flags.

- Mismatched IP Address and Account Location: Frequent IP address changes, such as those from different countries or regions, suggest the use of proxy services or VPNs.

- Payments from Cards with Poor Histories: Cards or accounts previously associated with fraudulent activities or suspected manipulation of ad traffic may be flagged.

- Facebook’s System Errors: Technical glitches, algorithmic mistakes, or misinterpretations of data can occasionally trigger blocks.

Classification of errors: what are the different types of risk payments on Facebook Ads?

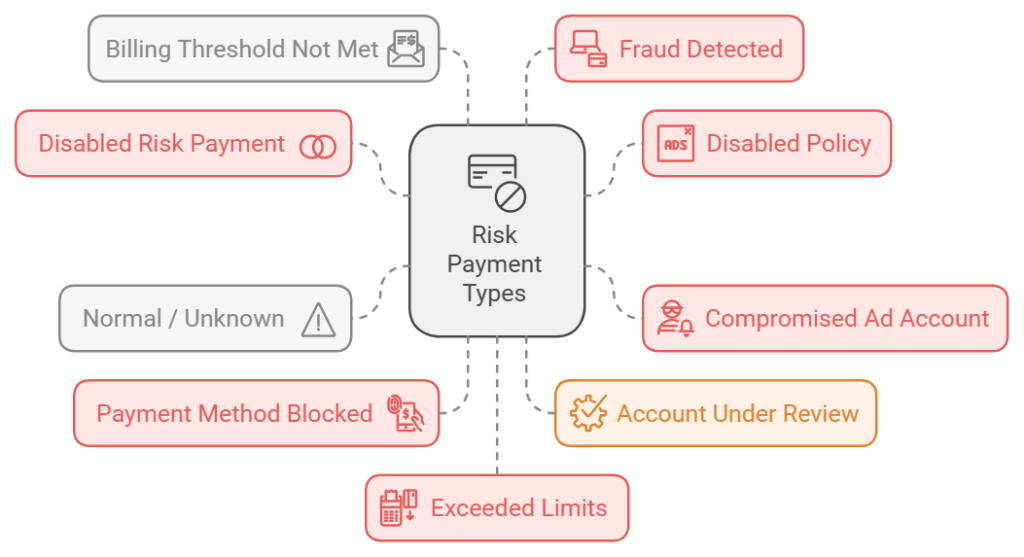

When the system classifies a payment as a Risk Payment, it also indicates the reason for the decision. You can find the error status in the Billing&Payments section of your account.

Each type of block has its own designation:

- DISABLED RISK PAYMENT: Facebook’s verification systems cannot confirm the security of the payment method. For example, this could happen if an incompatible card is used for Facebook.

- DISABLED POLICY: Violation of Facebook’s advertising policies. This occurs when the payment method or account violates the platform’s internal requirements.

- COMPROMISED AD ACCOUNT: Triggered when the ad account is suspected of being hacked. Major triggers include sudden changes or attempts to use new cards on new devices, as well as large transactions from different regions.

- NORMAL / UNKNOWN: The reason for the block is not entirely clear to the system, but there is a cause. This can occur due to a combination of suspicious actions or an attempted hack. Sometimes it indicates issues with the security system.

- PAYMENT METHOD BLOCKED: The payment method is blocked by the system due to frequent declines, suspicious transactions, or non-compliance with the platform’s policies.

- ACCOUNT UNDER REVIEW: A block requiring additional account verification. This happens due to unusual activity or changes to the account’s country or address.

- BILLING THRESHOLD NOT MET: Triggered if the payment limit (threshold) is not calculated correctly, or if the system suspects that the declared balance does not match the actual balance.

- FRAUD DETECTED: Facebook’s algorithms detect signs of fraud. For example, a one-time card was used for payment or the account is using proxy services.

- EXCEEDED LIMITS: The payment attempt fails due to exceeding the card or platform limits.

- TEMPORARY LOCK: The payment is halted until the user confirms their identity or the authenticity of the payment method.

- PREAUTH: A block occurs if Facebook is unable to temporarily hold funds on your payment method. This may happen if the card or payment method has restrictions on temporary holds.

What to do if a risk payment occurs?

If your payment is blocked, don’t panic. To increase your chances of restoring the account, respond to the issue quickly. Each type of error requires its own solution. To understand which one applies to you, you need to know the cause of the Risk Payment.

-

Payment method issues:

Errors: DISABLED RISK PAYMENT / PAYMENT METHOD BLOCKED / PREAUTH / EXCEEDED LIMITS

What to do? Replace your current card with one that has 3D Secure from a reliable bank. Make sure the new card is linked to your name and matches the country listed in your Facebook account. Don’t forget to top up the balance on the new card.

-

The payment method violates Facebook’s policies:

Errors: DISABLED POLICY / BILLING THRESHOLD NOT MET

What to do? Find the violation details in the Account Quality section. If it is related to the payment method, replace the card with one that complies with Facebook’s policy. Then submit an appeal via the Request Review button in the same section. Be sure to describe in detail how you corrected the issue.

-

Your account was hacked or fraudulent activity was detected:

Errors: COMPROMISED AD ACCOUNT / FRAUD DETECTED

What to do? Immediately change your account password and enable two-factor authentication. Then check the list of account administrators and remove anyone you don’t recognize. Don’t forget to check your payment methods. Remove any cards that are not registered to you. Finally, contact Facebook support to clarify your next steps.

-

Systemic or temporary blocks:

Errors: NORMAL / UNKNOWN / TEMPORARY LOCK / ACCOUNT UNDER REVIEW

What to do? Check the account’s activity and remove any payment methods that may have caused the block, such as cards with incorrect limits. Then contact Facebook support and describe the situation. You will need to verify your identity, so be ready with documents.

Keep in mind:

Sometimes a Risk Payment occurs not due to user errors but because of Facebook algorithm failures. It’s important to remember this so you don’t waste time trying to identify the problem in your actions, replace the card, or set up a new one. If you’re confident in your payment method and account activity, immediately send a request to support. Include the transaction ID and describe the issue.

After receiving a Risk Payment, analyze the situation. You need to understand which transaction or actions triggered the payment block to avoid repeating them in the future.

Contacting Facebook Help Center:

- Go to the Meta Business Help Center

- Depending on the issue, you’ll need either the Account Quality or Payment Issues section

- Click Contact Support or Request Review

- Write your inquiry. Include your account ID and ad campaign ID (if applicable). Don’t forget to attach documents and screenshots of the error notification

Avoiding risk payments: strategies and best practices for Facebook Ads

How to ensure payments go through smoothly?

To avoid payment blocks on Facebook Ads, you need to understand the reasons behind Risk Payments and know the logic behind the Meta platform’s payment method verification.

- Use special cards for Facebook Ads

Facebook works better with specialized cards for media buying. These cards have a higher chance of passing the automatic verification as they have suitable BINs, the right payment system, and currency. Today, there are many providers offering virtual cards for ad payments. To choose a reliable one, read user reviews and analyze the market.

- Increase your budget gradually

Even if the client demands quick results, don’t rush. Start with minimal spending and increase it by 10-15% daily.

- Create a “clean” infrastructure

Use separate accounts for media buying. Never link them to personal information or your bank account.

Life Hack: For each new client, create a separate business manager. If one account gets blocked, the others will remain unaffected.

- Ensure that payment locations and ads are linked

Payments should be associated with the geographical location of the target audience. If you’re running a campaign for the USA, use a card from an American bank.

Life Hack: To find out the information about the issuing bank, use BIN checkers. This online tool decodes information about a card based on its first 6 digits.

- Avoid suspicious schemes

Facebook recognizes schemes that violate its policies, such as artificial clicks or low-quality proxy servers. Always use reliable proxy services and never run ads through IPs from high-risk countries.

Life Hack: To choose the best proxy service, refer to advice or case studies from other media buyers. You can use specialized Telegram channels or forums to find the information you need or ask a more experienced colleague directly.

What features of Meta should be considered for ad payments?

Facebook analyzes not just the current transaction, but the account’s entire payment history. In general, if your payments are consistently going through because you follow the platform’s rules and use appropriate payment methods, the verification systems will start trusting your account.

New cards or new accounts are treated with caution by the system. Therefore, it’s important to avoid Risk Payments at this stage. Start with small payments on a new card and manually monitor that the first transactions go smoothly.

It’s also important to note that Facebook regularly updates its algorithms and payment verification technologies. The reasons for Risk Payments can change, so media buyers need to stay up-to-date on any changes and updates to Meta’s policy.

Conclusion

So, we’ve covered what Risk Payment is and how it occurs. Facebook uses special algorithms and mechanisms to analyze transactions and account behavior. A Risk Payment is a payment that these mechanisms determine as potentially suspicious. This typically means that the system detects signs of fraud or policy violations in the transaction.

The reasons for a block can be related to user errors (incorrect payment data), Facebook system malfunctions, policy violations, or threats to user data security. Each type of block has a specific name that helps understand how to resolve the associated issues.

We also identified simple strategies and rules that we hope will help media buyers avoid Risk Payments and the negative consequences that come with them.