Ever wondered how your personal information is protected when you make online payments? As digital transactions in India grow rapidly—thanks to better smartphones, more affordable mobile internet, and new technology—payment service providers are always working to make things smoother for you. But with this growth comes new risks, like more chances for fraud.

Making sure that payment gateways in India comply with data privacy laws is essential to protect customers and maintain trust. This helps protect customers, builds trust, and keeps businesses running smoothly.

Keep reading to know why complying with these regulations is so important for payment gateways in India and how they keep data secure.

Ensuring Trust and Safety in Online Transactions

Let’s say your business provides a seamless, secure payment experience for customers. This is achievable with India’s data privacy laws and the stringent measures adopted by payment gateways. Let’s explore how this works:

1. Data Privacy Laws in India

How do payment gateways ensure that personal data stays secure? Let’s begin by reviewing the key data privacy laws and rules in India. These laws are designed to protect personal information and set clear rules for handling it.

- The Information Technology ACT: These rules require businesses to use stringent security measures to protect sensitive data. They ensure that payment gateways have the right tools and practices to protect your personal information.

- The Digital Personal Data Protection Act, 2023: This new law, also called the DPDP Act or DPDPA-2023, focuses on managing personal data. It gives people control over their own data, like knowing what’s collected and how it’s used. It also sets up the Data Protection Authority (DPA) to ensure companies follow these rules and protect people’s privacy.

These laws shape how payment gateways operate in India. This helps build trust and keeps your information secure while you make online payments.

2. Data Protection Measures

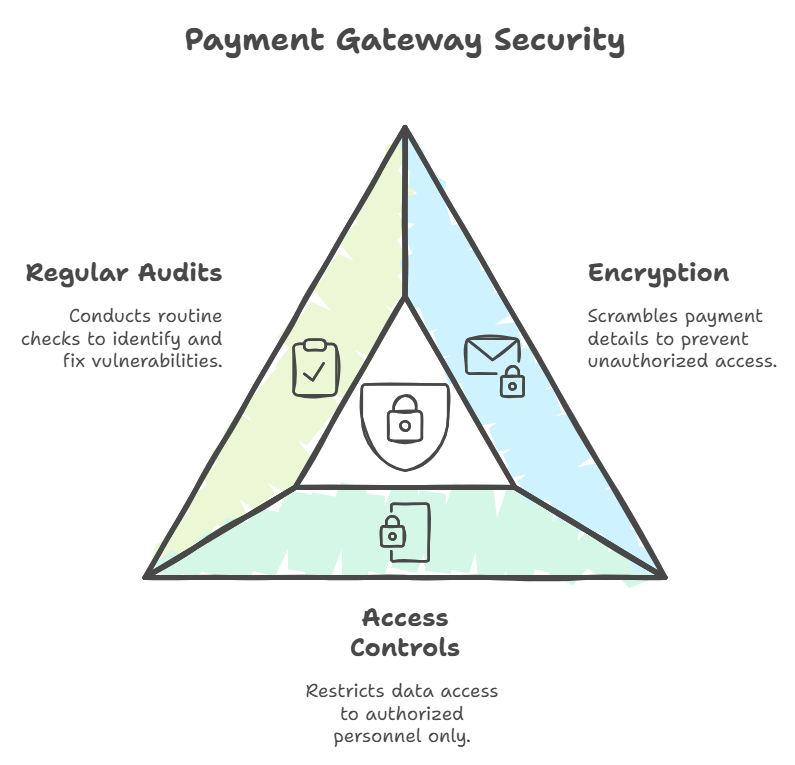

How do payment gateways ensure your payment information stays secure? Here’s a breakdown of their key practices:

- Encryption: Think of encryption as a code for your payment details. When you make a payment, your information is scrambled, so only authorised systems can understand it. This protects your data while it’s sent from your device to the payment gateway, keeping it safe from prying eyes.

- Access Controls: Payment gateways set strict rules for who can see your sensitive information. Only authorised personnel with the right permissions can access this data, which helps prevent unauthorised access and potential misuse.

- Regular Audits: Regular audits are like routine check-ups for the payment gateway’s security. They involve reviewing system logs, checking for vulnerabilities, and ensuring compliance with data protection rules. They are a way to spot and fix issues before they become major problems.

For encryption, technologies like TLS (Transport Layer Security) are widely used to protect data during transactions. Regular audits might include examining system access logs and security configurations to ensure everything functions correctly.

3. Handling Data Breaches

So, what happens in case of a data breach? Here’s how payment gateways handle such situations:

- Incident Response Plans: Payment gateways have detailed plans for data breaches. These plans outline steps to stop the breach, address the issue, and recover any affected data. Quick action is needed to minimise damage and protect your information.

- Notification Requirements: Payment gateways must inform the affected individuals and the relevant authorities about the breach. This ensures that those impacted can take necessary precautions and that the breach is properly documented.

- Preventive Measures: Payment gateways implement various security improvements to prevent future breaches. This might include upgrading systems, enhancing encryption methods, and training staff on security best practices.

Various threats, including hacking and phishing attacks, can cause breaches. For example, the Reserve Bank of India reported a 34% increase in fraud cases involving cards and internet banking from 2019–20 to 2021–22. This highlights the significance of strong security measures to protect against evolving threats.

4. Ensuring Customer Consent

How do payment gateways handle your data? Ensuring you’re informed and in control is crucial:

- Obtaining Consent: Payment gateways must get your permission before collecting or using your data. This usually means you’ll see clear notices explaining what data is being collected and how it will be used. You’ll often be asked to agree to these terms before completing your transaction. This consent is not just a formality; it ensures that you know and agree to how your information is managed.

- Transparency: Payment gateways also work to be transparent about their data practices. This means providing easy-to-understand privacy policies and updates about your data use. Transparency helps build trust, letting you know exactly how your data is being handled and stored.

For consent, you might encounter a pop-up or a checkbox during the checkout process that asks for your agreement to data collection. Transparency practices could include detailed privacy statements on the payment gateway’s website, clearly explaining their data handling practices.

Keeping Your Data Safe and Sound

Keeping your customers’ data safe has never been more important. With the surge in online transactions, choose is a payment gateway that follows data privacy laws to protect your business and customers.

Take, for instance, a solution like Plural. Plural stands out because it doesn’t store sensitive data and uses top-notch SSL encryption to ensure every transaction is safe. When you opt for a payment gateway that prioritises these security measures, you’re building trust with your customers.

So, as you sift through your options, look for a gateway that excels in data protection. Plural’s approach to security can help you maintain that trust and keep your transactions smooth and secure.