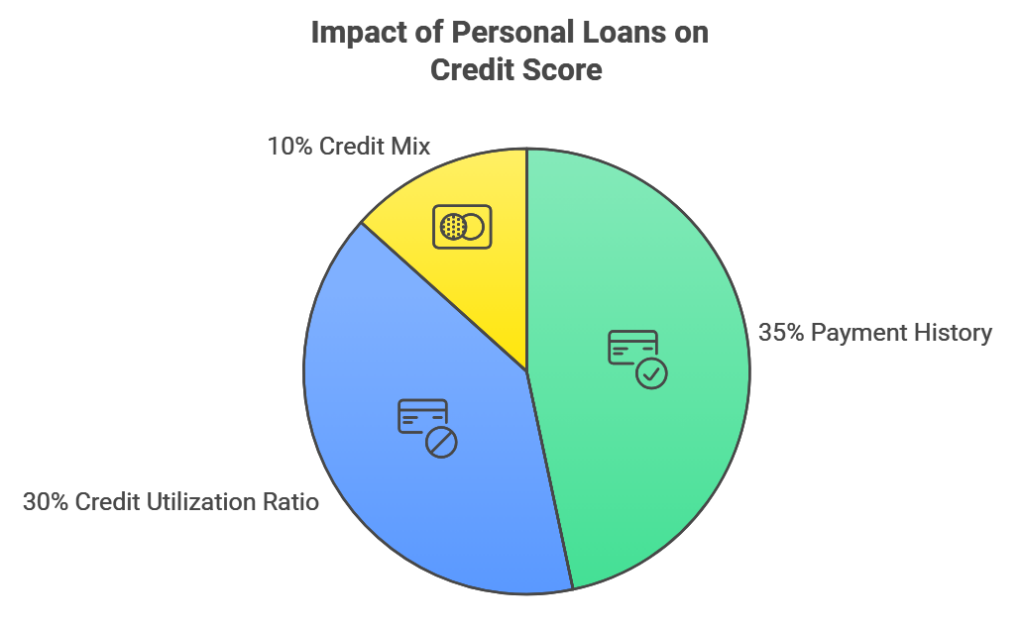

When people think about personal loans, they often focus on the debt aspect, but there’s another side to the story. Did you know that personal loans can actually be a tool to help you build credit? It might sound surprising, but using Singapore personal loan wisely can positively impact your credit score. This is because they can contribute to important factors like your payment history, credit mix, and credit utilization ratio. Together, these three elements make up a significant portion of your credit score—75%, to be exact.

If you’re considering a personal loan, whether for a big purchase or to consolidate existing debt, finding debt relief with a consolidation loan can be a strategic move. Let’s dive into how personal loans can help you build credit and what to keep in mind if you decide to go this route.

How Personal Loans Affect Your Credit Score

Before we get into the specifics, it’s helpful to understand how credit scores are calculated. Your credit score is made up of several factors, but the three most influenced by personal loans are:

- Payment History (35%): This is the record of your on-time payments on all your credit accounts. Consistently making payments on time is one of the most significant ways to build a positive credit history.

- Credit Utilization Ratio (30%): This is the amount of credit you’re using compared to the total amount available to you. Keeping this ratio low is crucial for a good credit score.

- Credit Mix (10%): This looks at the variety of credit accounts you have, such as credit cards, mortgages, and loans. Lenders like to see that you can manage different types of credit responsibly.

Now, let’s explore how personal loans play into these factors.

Boosting Your Payment History

One of the most effective ways to build credit is by showing a history of on-time payments. Personal loans can contribute positively to this aspect of your credit score. When you take out a personal loan and make your payments on time each month, it creates a record of responsible financial behavior. Over time, this consistent payment history can help boost your credit score.

Even if you already have other forms of credit, like credit cards, adding a personal loan to the mix can further strengthen your payment history. It’s important to remember that every payment you make on time is reported to the credit bureaus, adding to your track record of reliability.

Improving Your Credit Utilization Ratio

Credit utilization ratio primarily applies to revolving credit, like credit cards, but personal loans can indirectly help with this factor as well. By using a personal loan to pay off high credit card balances, you can lower your overall credit utilization ratio.

For example, if you have several credit cards that are close to their limits, taking out a personal loan to pay them off can reduce the percentage of available credit you’re using. This, in turn, can improve your credit score. It’s like killing two birds with one stone—you reduce your credit card debt and potentially boost your credit score at the same time.

Diversifying Your Credit Mix

Lenders and credit bureaus like to see that you can handle different types of credit. This is where personal loans can come in handy. If your credit profile mostly consists of revolving credit, like credit cards, adding a personal loan can diversify your credit mix. This shows lenders that you’re capable of managing various types of credit responsibly, which can be a plus for your credit score.

It’s important to note that while having a mix of credit types can help, it shouldn’t be the sole reason for taking out a personal loan. You should have a clear purpose for the loan and a plan to pay it off responsibly.

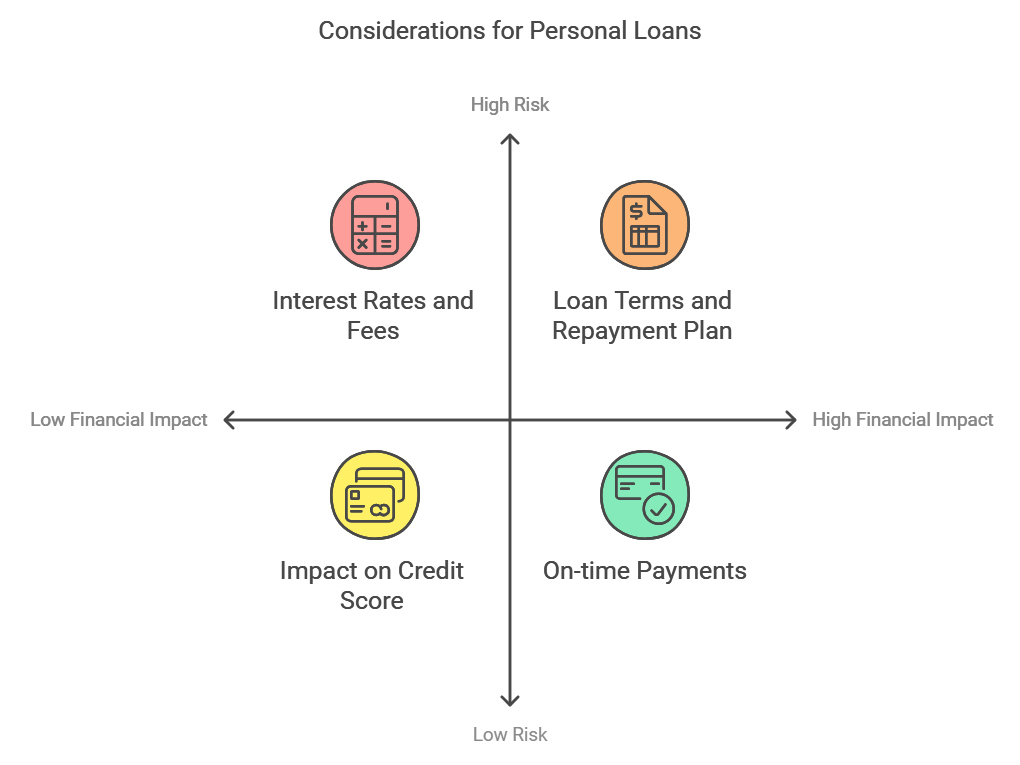

Things to Consider Before Taking Out a Personal Loan

While personal loans can be beneficial for building credit, they aren’t a one-size-fits-all solution. There are a few important considerations to keep in mind:

- Interest Rates and Fees

Personal loans come with interest rates and, sometimes, additional fees. It’s essential to shop around and compare offers to find a loan with a reasonable interest rate. The better your credit score, the more favorable the terms you’re likely to get.

- Loan Terms and Repayment Plan

Make sure you understand the loan terms, including the repayment schedule and any penalties for late payments. Missing payments or defaulting on a personal loan can severely damage your credit score, so it’s crucial to have a solid plan for making payments on time.

- Impact on Credit Score

When you apply for a personal loan, the lender will perform a hard inquiry on your credit report, which can cause a slight dip in your credit score. However, this impact is usually temporary, and as you make on-time payments, the positive effects on your credit score can outweigh the initial dip.

Using Personal Loans for Credit Card Consolidation

One of the most common and effective uses of personal loans is for consolidating high-interest credit card debt. By consolidating multiple credit card balances into one personal loan with a lower interest rate, you can simplify your payments and potentially pay off your debt faster. This can lead to a lower credit utilization ratio and an improved credit score over time.

If you’re considering this option, finding the Best Credit Card Consolidation Loans can be a smart way to start. Look for loans with low-interest rates and favorable terms that fit your budget.

Conclusion: Personal Loans as a Credit-Building Tool

While personal loans are a form of debt, they can be used strategically to build and improve your credit score. By contributing to your payment history, potentially lowering your credit utilization ratio, and adding diversity to your credit mix, personal loans can have a positive impact on your overall credit profile.

However, it’s important to use personal loans wisely. Make sure you understand the terms, have a clear plan for repayment, and only borrow what you can afford to pay back. When used responsibly, personal loans can be a valuable tool in your journey to better credit. So, whether you’re looking to consolidate credit card debt or simply build a stronger credit profile, personal loans offer a pathway to achieving those financial goals.